From the rise of budget-friendly second-tier airports to embracing new “airport divorce” habits, travelers are balancing rising costs, crowded hubs, and shifting global politics with their desire to keep exploring.

While Americans are still eager to travel, they’re adapting their behavior through budget adjustments and by reevaluating international destinations.

Using newly released data from the Bureau of Transportation Statistics (BTS) and a nationwide survey, LocalsInsider examined the most popular destinations for American travelers, the international cities on the rise, as well as the drop in international visitors to the U.S. since last year, which has declined by more than one million.

The results reveal not only where travelers are headed, but also how inflation, politics, and evolving habits are reshaping the way Americans approach travel.

Highlights

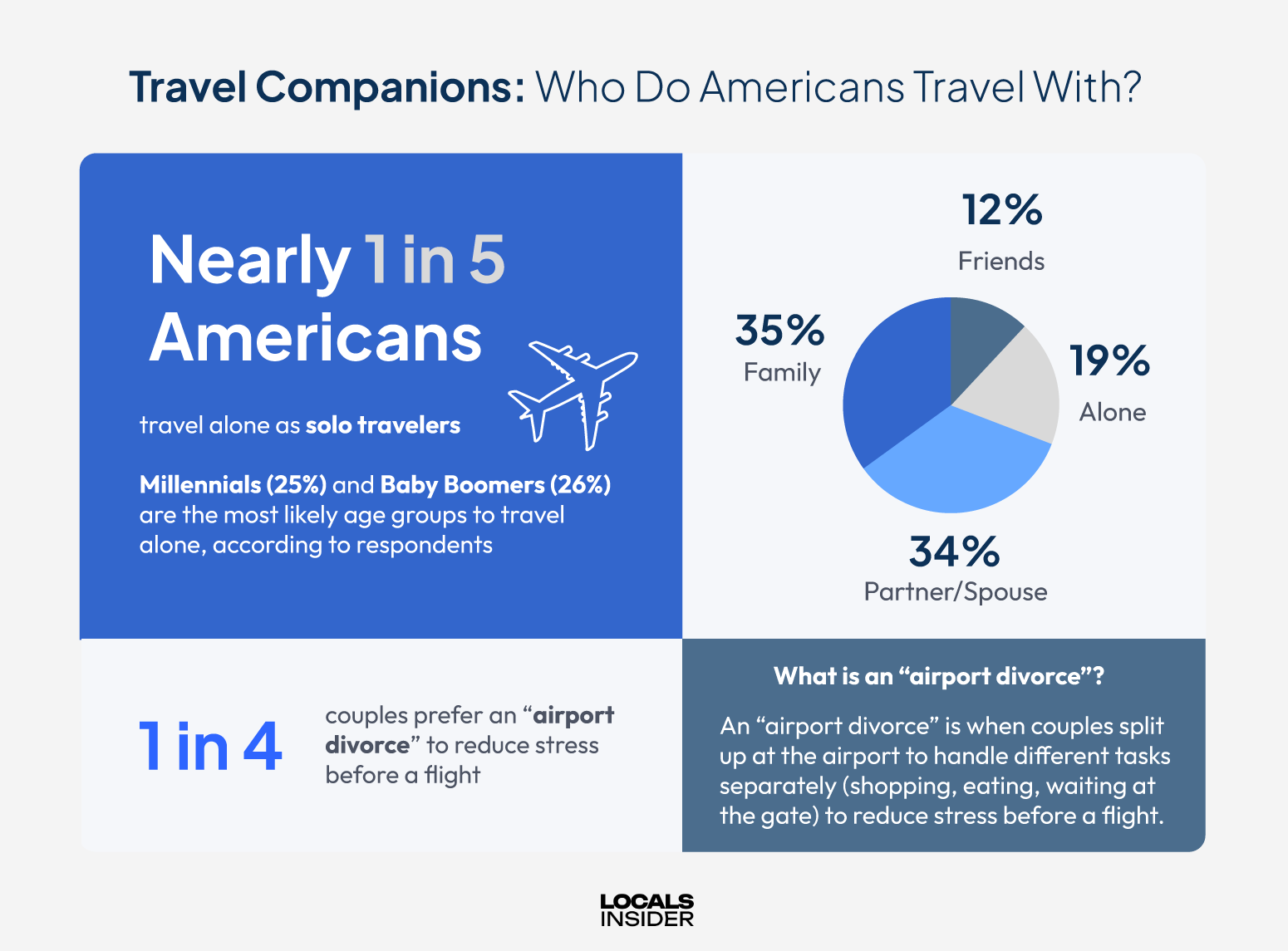

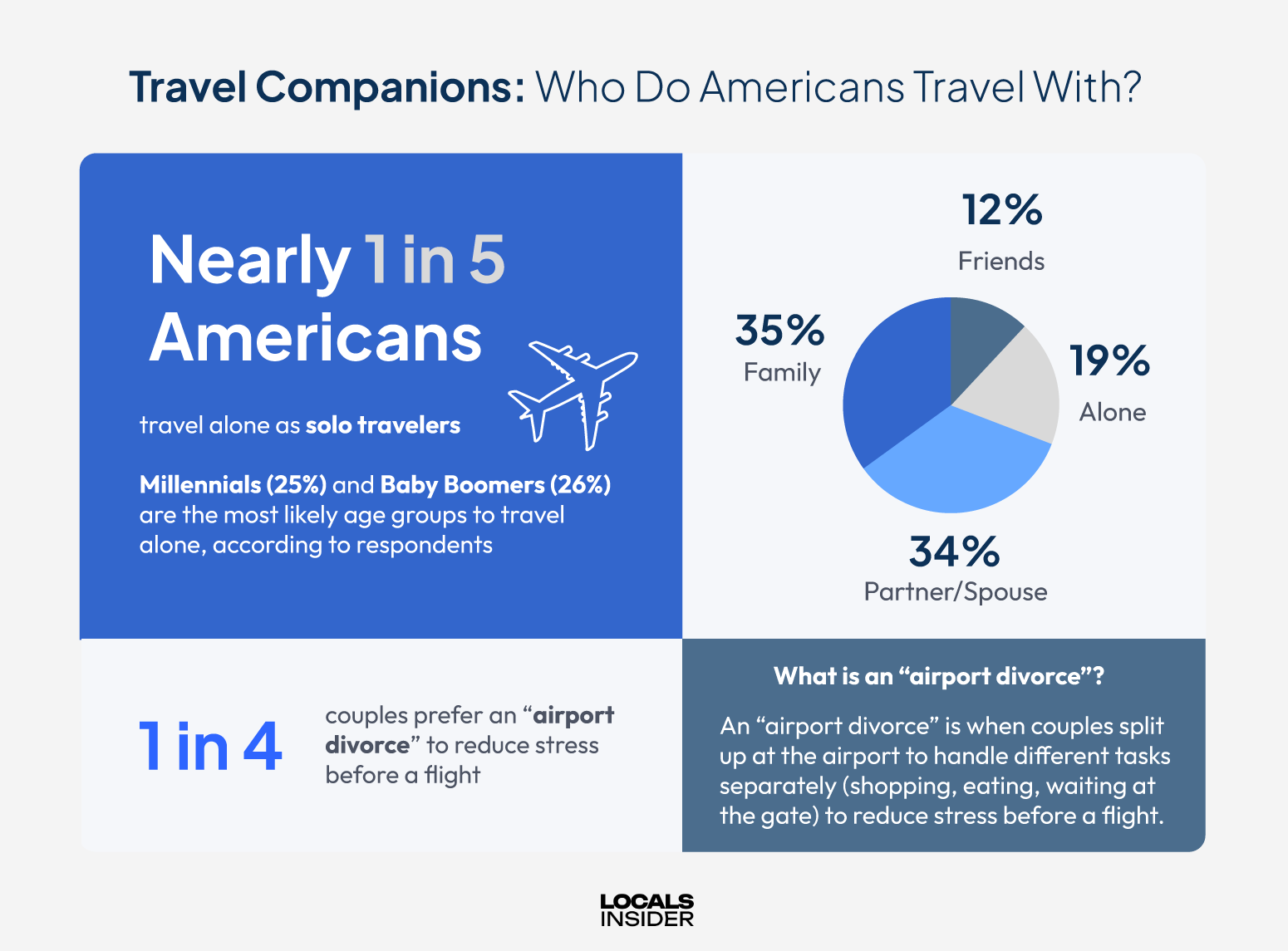

Traveler Habits: Nearly 1 in 5 Americans say they travel alone, while 1 in 4 couples prefer an “airport divorce,” or splitting up at the airport to reduce stress.

Emerging Hotspots for 2026: Secondary airports like Washington Dulles International and Orlando Sanford International are seeing double-digit passenger growth, signaling demand for lower-cost alternatives. Internationally, destinations such as Shanghai, Hong Kong, and Rio De Janeiro are surging.

Winter Travel Outlook: The average American winter travel budget is $2,036 for flights and accommodations, but 42% say rising costs have already forced them to cancel or reconsider a trip.

Decline in International Visitors: Total international arrivals to the U.S. dropped by more than one million people year-over-year.

Passport Demand: States in the South are seeing the fastest YoY growth in passports, even though overall passport ownership lags behind coastal regions.

Emerging U.S. Travel Hotspots

Domestic airports aren’t just about the big hubs anymore. While giants like JFK, LAX, and Atlanta still dominate in raw passenger numbers, a growing number of secondary airports are seeing double-digit growth this year. These rising destinations suggest travelers are looking for cheaper fares, easier connections, and less congested options.

According to Bureau of Transportation Statistics passenger data (Jan-July 2025 vs. Jan-July 2024), the fastest-growing domestic airports include Knoxville, TN (McGhee Tyson), Washington, DC (Washington Dulles International), Providence, RI (Rhode Island Green International), Orlando, FL (Orlando Sanford International), and St. Petersburg, FL (St. Pete Clearwater International).

These mid-sized airports often serve as affordable alternatives to crowded hubs, which makes them attractive for cost-conscious travelers.

Rising International Destinations

Internationally, several major global cities are rebounding sharply or emerging as new favorites for American travelers, with Asia and Latin America driving much of the momentum. These destinations include Shanghai, China (+47%), Hong Kong (+46%), Monterrey, Mexico (+33%),

Rio de Janeiro, Brazil (+30%), and Osaka, Japan (+28%).

Many of these destinations are seeing expanded U.S. routes, which is fueling their passenger growth.

U.S. Destinations on the Decline

As travelers chase new hotspots, some destinations are seeing reduced passenger traffic whether due to rising costs, shifting airline schedules, or evolving traveler preferences, some destinations are seeing a decrease in visitors. Below are airports and countries where U.S. and international travel has decreased the most in 2025.

According to BTS data comparing Jan–July 2025 with the same period in 2024, these U.S. airports saw the largest decline in passenger traffic among major airports:

International Destinations on the Decline

Fewer International Visitors Coming to the U.S. in 2025

While U.S. travelers are shifting their habits in terms of international destinations, the U.S. is seeing fewer international visitors in 2025.

According to the International Trade Administration, total international arrivals to the U.S. dropped by more than one million people year-over-year as of June 2025.

The steepest decline comes from Canada, which is historically the U.S.’s largest source of inbound visitors. Canadian arrivals fell by 1.75 million travelers over the past year, an 18% decrease.

The Canadian decline alone outpaces the overall U.S. drop, which highlights how other countries such as Mexico, India, and Western Europe are helping to partially offset the losses.

Broader policies are also playing a role in the slowdown. Recent changes include a new $250 visa fee for many foreign travelers, increased fees for H-1B visa applicants from India and China, which can potentially discourage both business and leisure travel.

How Americans Are Traveling in 2025

Alongside analyzing BTS passenger data, LocalsInsider surveyed Americans about their overall travel behaviors. The results highlight how cost pressures and stress are shaping habits.

According to respondents, the majority of Americans (60%) travel for leisure, while 1 in 4 (26%) say they travel to visit family and friends. In terms of lodging preferences, more than half of travelers (51%) opt for hotels compared to 25% who prefer vacation rentals.

Most Americans still travel with others, but nearly one in five prefer to travel solo, with Millennials (25%) and Baby Boomers (26%) being the most likely generation to take trips alone.

Among couples, nearly one in four admit to preferring an “airport divorce,” which refers to couples splitting up during the airport process to reduce stress, and about one in ten say they actually feel more relaxed when they do so.

When it comes to winter travel, the average American has budgeted $2,036 for flights and accommodations this season. However, inflation is weighing on winter travel plans, with 42% saying rising costs have already forced them to cancel or reconsider a trip, and one in five expect to travel less this winter compared to last year.

Passport Demand by State

While flights and destinations tell us where Americans go, passport issuance reveals who is gaining greater travel access.

Data from the U.S. State Department shows that some states in the South and interior U.S. are leading the nation in passport issuance growth, even though historically they’ve had lower rates of residents with valid passports.

For example, states like Arkansas, Mississippi, and Tennessee saw year-over-year increases in passports issued. Meanwhile, states with traditionally high rates, like New Jersey, New York, and Massachusetts, saw a decrease in new passports being issued.

Most Popular U.S. Destinations in 2025

Despite the rise of secondary airports and new emerging hotspots, the busiest hubs still dominate when it comes to raw passenger traffic.

According to BTS data, the top U.S. destinations this year include Atlanta, Denver, Dallas, Chicago, and Las Vegas. These destinations remain leaders due to a mix of business, tourism, and international connectivity.

Along with being among America’s biggest cities, they’re also leisure capitals, with Orlando and Las Vegas continuing to attract families and vacationers in massive numbers this year.

Most Popular International Destinations in 2025

On the international side, London tops the list of overseas destinations for American travelers, followed closely by Cancun and Toronto. Other top spots include Mexico City, Paris, Seoul, Frankfurt, and Vancouver.

Overall, travelers are seeking out lower-cost alternatives at secondary airports, while the U.S. is grappling with a decline in inbound international visitors.

While the busiest hubs still dominate overall passenger volumes, the way Americans are traveling is evolving both domestically and internationally.

Methodology

In September 2025, LocalsInsider analyzed newly released passenger data from the U.S. Bureau of Transportation Statistics (BTS) covering the period January through July 2025, as well as visitor arrival data from the U.S. International Trade Administration. The analysis compared year-over-year passenger counts by airport and country to identify the fastest-growing and fastest-declining destinations for U.S. and international travelers.

Domestic and international “emerging hotspots” were determined by calculating percentage increases in passenger arrivals from 2024 to 2025.

Additionally, data from the U.S. State Department was used to examine year-over-year growth in U.S. passport issuances by state.

In September 2025, LocalsInsider conducted a nationwide survey of 1,000 respondents to better understand American travel habits in 2025. Questions covered topics such as winter travel budgets, lodging preferences, solo travel frequency, and the growing trend of “airport divorces.”

Survey Demographics

Gender: Female (50%); Male (48%); Non-binary (2%)

Age Range: 18 – 87 (average: 46 years old)

Household Income Distribution:

Under $20,000 (14%); $20,000 – $40,000 (20%); $40,001 – $60,000 (19%); $60,001 – $80,000 (16%); $80,001 – $100,000 (11%); $100,001 or more (20%)

Limitations

Self-reported survey data may be subject to recall bias or social desirability bias.

Passenger data is based on publicly reported BTS arrivals, which may be revised in later releases.

While percentage growth highlights emerging trends, absolute passenger counts vary widely between major hubs and smaller airports.

Sources

U.S. Bureau of Transportation Statistics, U.S. International Trade Administration, U.S. State Department Passport Services