Lately I keep seeing these apps where you can predict literally anything—elections, the weather, even where the next White Lotus will be filmed. It’s wild.

I started messing around with them the same way you might open a crossword on the subway or a puzzle game on a flight. The difference is here you’re not just killing time—you’re trading on the future. Feels like a mix of Wall Street, Vegas, and pop culture gossip rolled into one.

Of course, not every site is legal everywhere, so I decided to make a list of the best prediction market sites you can actually use in the US right now and in 2026.

Best Legal Prediction Market Apps In The US

Prediction markets are the hottest and newest way to get action (bet) on sports, political, and pop culture outcomes. They are also the most volatile form available allowing you to get this action.

Are prediction markets gambling? That’s the crux of the issue causing the turmoil over these sites, which are growing in popularity by leaps and bounds.

While sports betting apps like Bet365 and BetRivers enable you to place bets against the house and are governed by state gambling regulatory bodies, prediction markets operate in similar fashion to commodities exchanges. Prediction market sites are regulated by the US Commodities Futures Trading Commission (CFTC).

The rapidly-growing popularity of prediction markets is evidenced by the fact that the top two online sports betting sites and online casinos in the US, FanDuel and DraftKings, are both angling to get in on the prediction market industry.

What Are Prediction Markets And How Do They Work?

Prediction market apps operate much like a commodities exchange.

Rather than betting against the house as you would wager at an online sports betting app, with prediction markets, you choose one side or the other of an issue and invest in a contract based on that outcome to occur. Instead of the vigorish, or vig, that you pay to the sportsbook on a sports bet, prediction markets require payment of a trading fee.

Succeeding in prediction markets is similar to how you would achieve success on the stock market. You want to buy low and sell high.

When you back a prediction market, you earn a profit if your pick comes in as a winner.

As prices fluctuate, you also have the option of selling your contract before the event concludes, if you are satisfied with the profit you’ve already made on your investment.

But here’s the thing: many of the biggest prediction market sites are actually crypto betting platforms or trading exchanges dressed up with fun markets. That means the rules, fees, and risks can be very different from sports betting apps you already know. Always read the terms and conditions carefully, check if the site is licensed in your state, and remember—these aren’t games for everyone.

Prominent prediction market apps in the US

DraftKings Predictions – new & live app

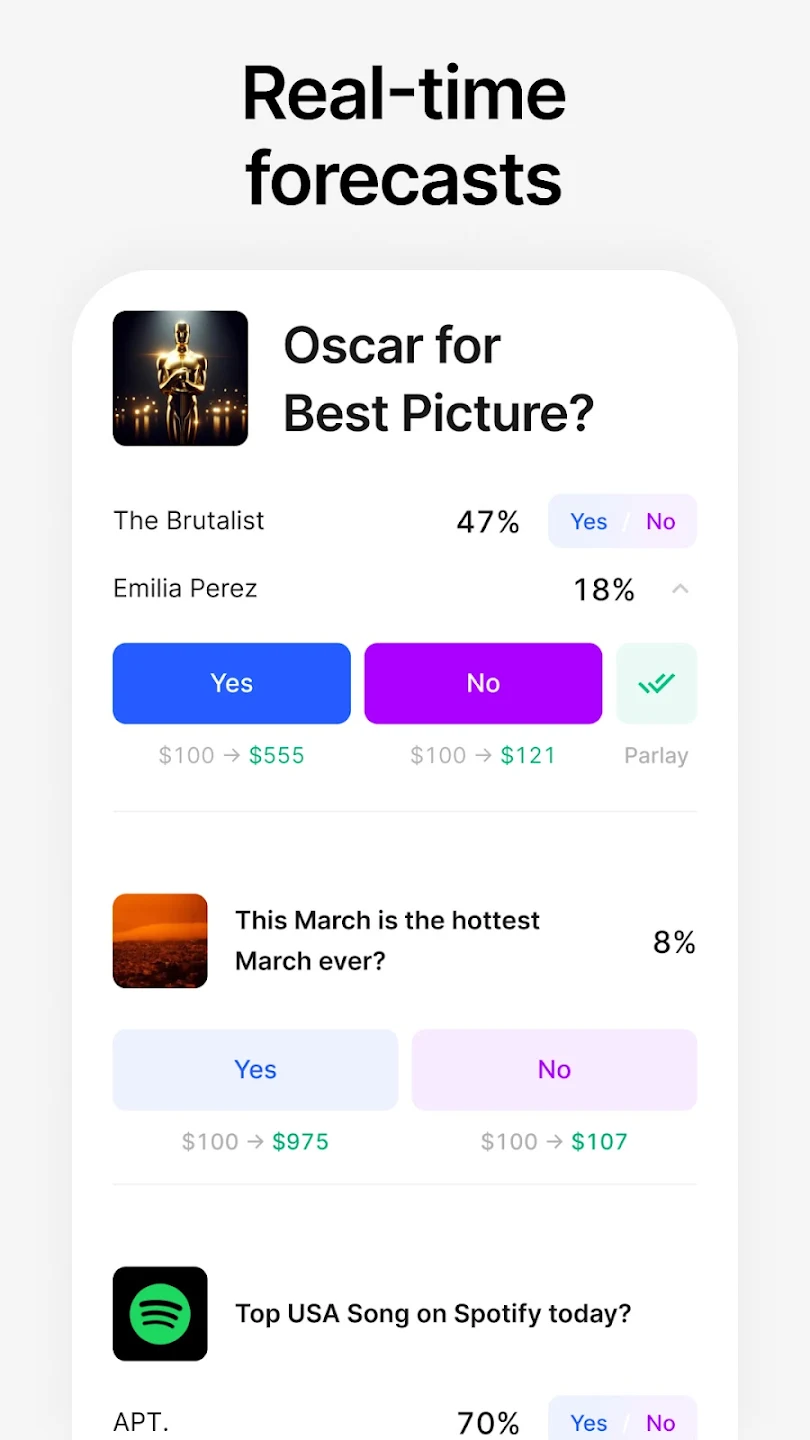

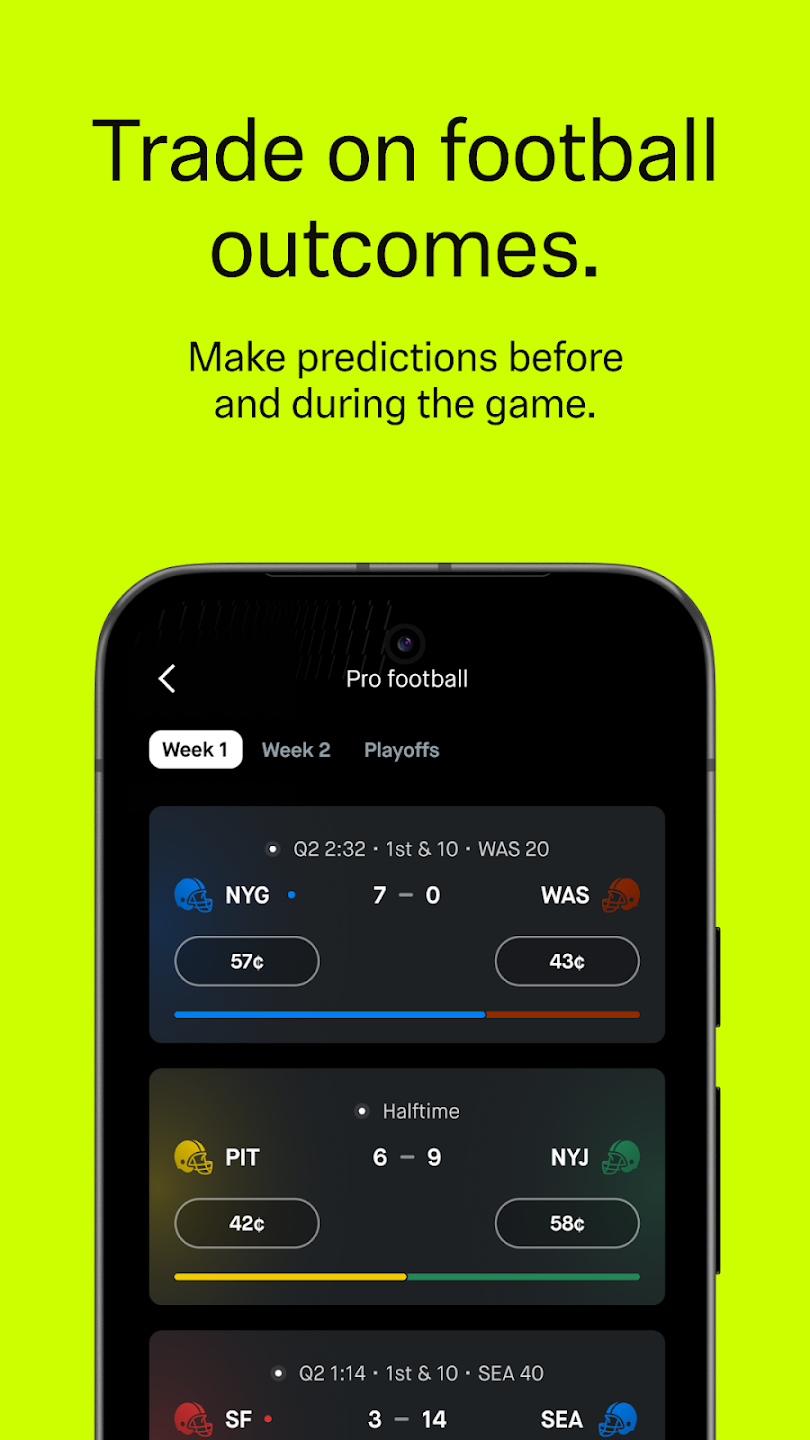

New DraftKings Predictions is a federally regulated prediction markets app launched on December 2025, designed to bring event-based forecasting to a mainstream sports audience.

Instead of traditional betting odds, users trade simple Yes or No contracts tied to real-world outcomes, with prices reflecting implied probability. Markets currently cover sports events (such as game results and season milestones) alongside financial and economic indicators, with entertainment and culture markets expected to expand in 2026.

Built on DraftKings’ sportsbook technology and media ecosystem, the app is positioned as a more intuitive alternative to sports betting, especially for casual users who prefer probabilities over lines. DraftKings Predictions is available to eligible users across 38 U.S. states, including several where traditional sports betting is not yet legal.

Kalshi

A New York-based startup, Kalshi was the first prediction site in the market to be regulated by the CFTC. The site offers prediction markets on individual sporting events, as well as futures markets on season outcomes.

Sports offered include football, basketball, hockey, soccer, tennis, and esports.

There are also prediction markets for politics, economics, financial markets, and pop culture-related issues. In 2024, Kalshi was the first US site to offer action on a US Presidential election in nearly 100 years.

You are choosing either a yes or no outcome with Kalshi’s prediction market contracts. Kalshi is offered in 46 of 50 states. Illinois, Nevada, New Jersey, and Ohio are the prohibited states.

Robinhood

During a recent earnings call, Robinhood revealed that the majority of its $1 billion in trades moved over the last quarter was earned in the sports event prediction market. The Robinhood prediction markets hub and all corresponding contracts are made available across the US market through the use of Kalshi’s platform.

Robinhood’s description of the prediction trading market is that it is at the intersection of news, economics, politics, sports, and culture. The site just announced it would be adding markets for pro and college football regular-season games in time for the 2026 season. Robinhood’s prediction markets are accessible in 49 of 50 states. Maryland is the lone exception. They claim that they already have 25 million active users.

You don’t pay any commission or foreign exchange fees—just a tiny 0.03% charge when moving money in or out of USD. On top of that, they pay 4% interest on any cash you’re not investing, insured by the FDIC up to $2.5 million.

- Android: 4.2 (510k+ ratings), ~200k downloads/month

- iOS: 4.3 (2M+ ratings), ~400k downloads/month

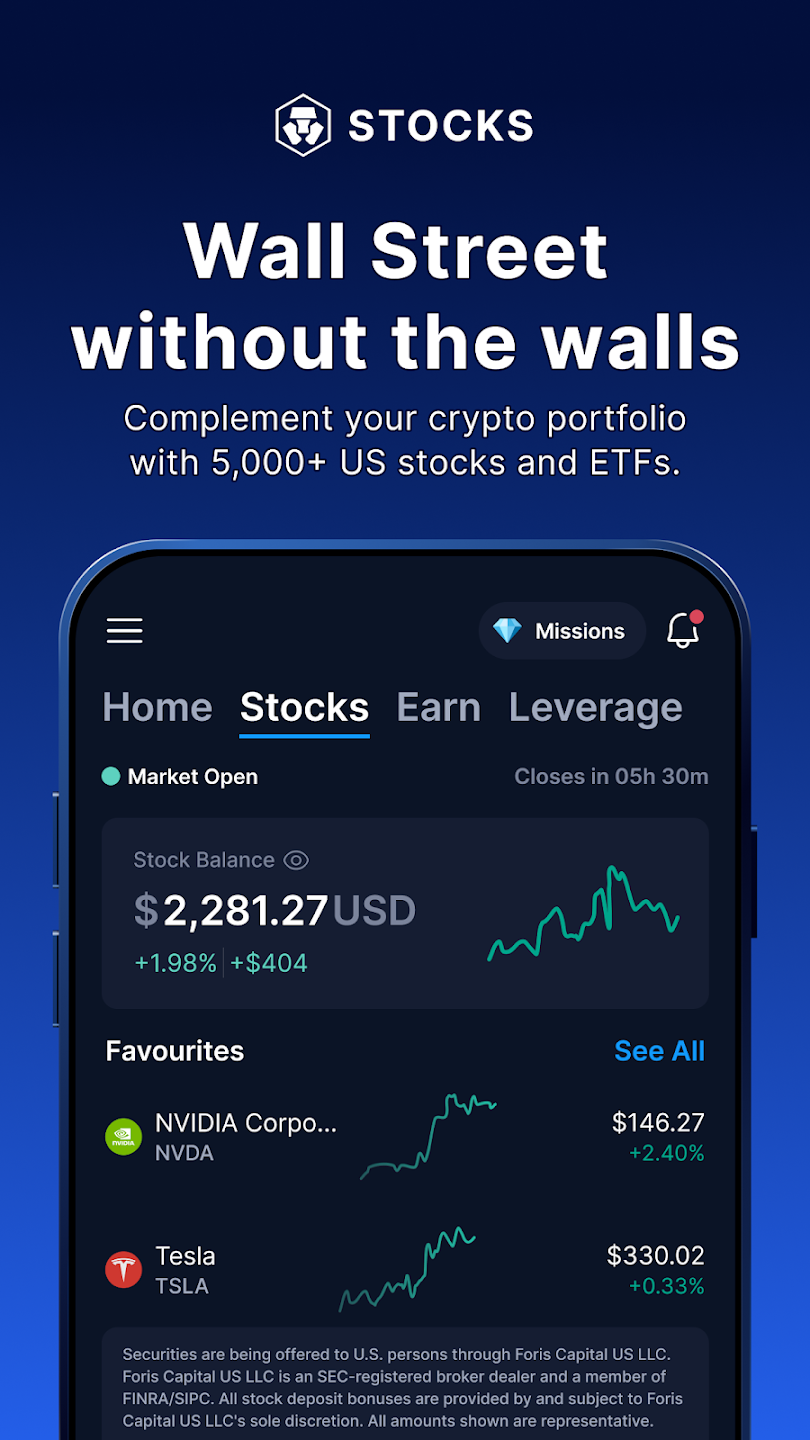

Crypto.com

Crypto.com first entered the sports end of prediction markets in time to offer contracts on the 2026 Super Bowl game. Unlike many of its rivals, Crypto.com’s prediction markets focus solely on sports outcomes, offered through its subsidiary Nadex. Crypto.com provides markets on North American football, basketball, hockey, and European soccer.

Despite what the company name suggests, this is not a crypto-only site. You can play the site’s prediction markets with Bitcoin or Ethereum. Or you can choose to invest in contracts with fiat currency. You win the equivalent of $100 with every successful contract. Crypto.com’s prediction markets can be accessed in all 50 US states, and they claim that over 150 million people are using crypto.com worldwide.

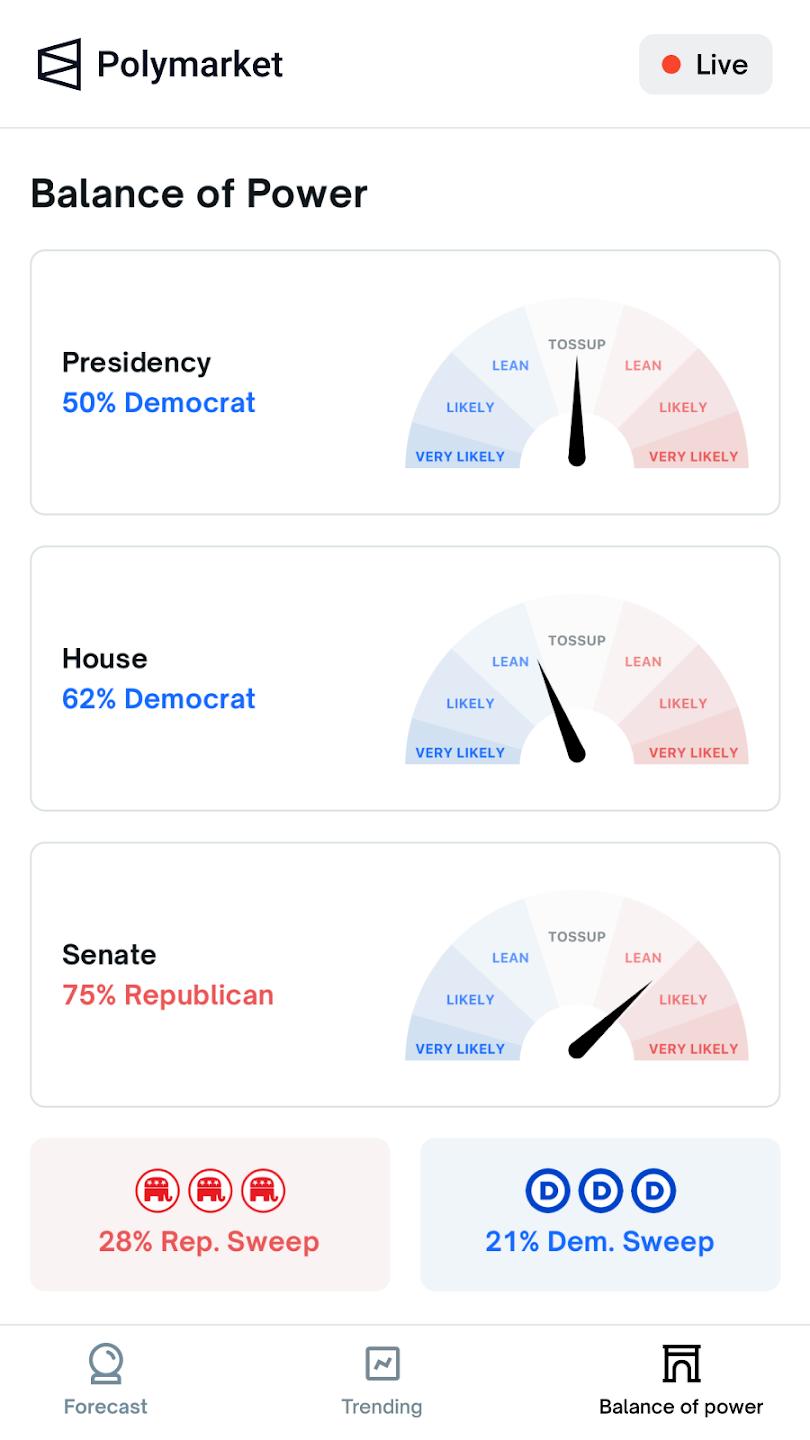

Polymarket

The world’s largest prediction market site, Polymarket app is poised to re-enter the US market following the company’s acquisition of the derivatives exchange clearinghouse QCEX. Polymarket had been banned from the US and was under investigation by the US Department of Justice, accused of accepting US customers without being regulated in the US market. The company has since been cleared of all charges.

Founded in 2020 by Shayne Coplan, Polymarket is an American cryptocurrency-based prediction market, headquartered in Manhattan, NY. Launched in 2020, it offers a platform enabling investors to make trades based on a number of future outcomes. Polymarket offers thousands of markets in politics, world events, pop culture, and sports.

Through the acquisition of QCX Exchange, Polymarket has CFTC approval to operate anywhere in the United States.

- Android: Rated about 3.2 from ~5.47K reviews; 110K+ downloads

- iOS: Rated 4.8 based on reviews

Interactive Brokers, IBKR

In 2024, Connecticut-based Interactive Brokers launched ForecastTrader. This web platform was designed exclusively for trading forecast contracts. Through ForecastEx, Interactive Brokers offers event contracts on political, economic, and financial market questions.

These exchange-traded investment instruments pay out $1 if a particular event happens. An example of such an event would be deciding whether to go with a yes or no answer on whether the Fed will raise interest rates. If you go with yes and it happens, you win $1. If it doesn’t happen, you end up with nothing. Interactive Brokers customers with permission to trade futures on the site can use ForecastTrader to speculate on outcomes in economic data, climate events, and even elections.

Interactive Brokers doesn’t offer sports prediction markets. The site is available in all 50 states.

With IBKR Lite, U.S. residents can trade U.S. stocks and ETFs at $0 commission, while IBKR Pro charges between $0.0005–$0.0035 per share (or $0.005 flat) depending on the tier. Options cost $0.15–$0.65 per contract, futures $0.25–$0.85 per contract, and forex trades use tight spreads (as low as 1/10 pip), with mutual funds either free (No Transaction Fee funds) or capped at 3%/$14.95 per transaction.

Android – GlobalTrader: Rated 4.2 from ~1.4K reviews; 106K+ downloads

Ninja Traders

Ninja Traders is a brokerage outfit that offers prediction markets as one of its products. This is done through a partnership with Tradovate. NinjaTrader doesn’t provide prediction markets on sporting events. The company offers event contracts on financial market questions.

These include what the various financial markets, such as the Dow Jones, S&P, or NASDAQ will close at by the end of the day’s trading. You can also take out contracts on the daily closing price of gold, silver, copper, crude oil, or natural gas.

Successful trades will earn you $100. Ninja Traders is accessible in all 50 US states.

Railbird Exchange

A trading company founded in New York in 2021, Railbird Exchange recently gained a license to operate as a federally regulated prediction market. In June, the CFTC granted Railbird a licence to operate as a designated contract market. The site is expected to launch later this year.

Railbird will allow users to trade event contracts on the outcomes of real-world events. The events can involve everything from economic indicators and public policy to entertainment or cultural trends. People who take out contracts must choose a position on the outcome of these real-world events. You must back the event to happen, or not to happen.

Railbird is expected to be available in all 50 US states. Already, there is speculation that sports betting giant DraftKings is looking into either partnering with or purchasing some or all of Railbird Exchange to be able to access the lucrative prediction market.

Manifold

A cryptocurrency-based platform, Manifold is offering prediction markets on politics, economics, financial markets, and pop culture questions. Players can invest and win virtual money, called “mana,” or use a form of cryptocurrency called “sweepcash.” Sweepcash can be accumulated and later traded for real-money dollars. A 5% fee will be incurred to make this cash transaction. However, if you choose to donate your sweepcash to charity, the 5% fee is waived.

Manifold is offered in 46 of 50 US states. The site is not available in Delaware, Idaho, Michigan, or Washington.

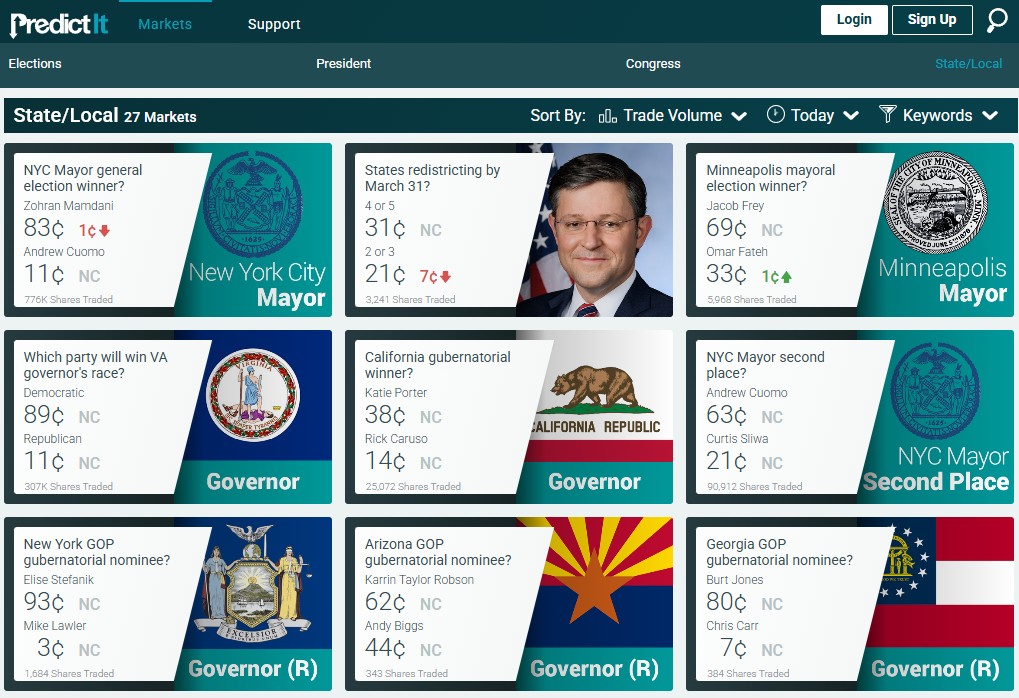

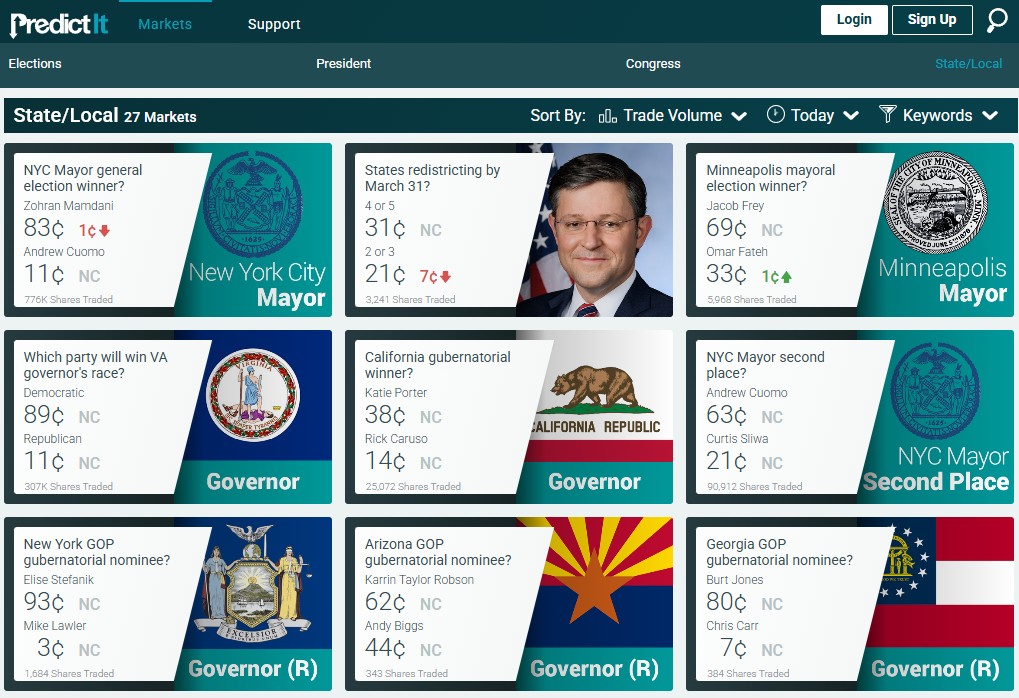

PredictIt

PredictIt.org was launched in 2014 by Victoria University of Wellington in New Zealand. The platform operates under a “No Action” letter from the U.S. Commodity Futures Trading Commission (CFTC), allowing it to function legally within specific guidelines. The stated purpose of PredictIt is to facilitate research into the way markets forecast events.

At PredictIt, the focus is solely on political outcomes. It’s important to keep in mind that PredictIt operates under preset legal guidelines. This factor may place limits on what the site can offer in terms of trading markets.

Players can invest up to $850 in any individual contract. PredictIt is available in each of the 50 US States.

Iowa Electronic Markets (IEM)

The IEM is an online futures market where contract payoffs are based on real-world events such as political outcomes, companies’ earnings per share (EPS), and stock price returns. The market is operated by the University of Iowa Henry B. Tippie College of Business faculty as an educational and research project. It operates in the not-for-profit realm.

Iowa and other colleges use these predictions as a pedagogical tool. The schools have found them to be an excellent method for students to focus attention and gain hands-on experience with real-world markets. As a research tool, the markets also provide educators with an unparalleled laboratory in which they can study individual trading behavior and market-level performance.

Trading accounts can be opened for amounts ranging from $5 to $500. Participants use their funds to buy and sell contracts. You can invest up to $500 in any specific contract. The IEM is accessible in all 50 US states.

The Best Prediction Market Betting Sites in the USA

- DraftKings Predictions – a new forecast app for Android and iOS that allows you to trade sports events and finance markets in 2026.

- Iowa Electronic Markets (IEM) – Educational futures market; political and financial outcomes.

- Kalshi – First CFTC-regulated prediction site; sports, politics, finance, culture.

- Robinhood Prediction Markets – Integrated with Kalshi; wide markets, including college & pro sports.

- Crypto.com (Nadex) – Sports-focused prediction contracts; accepts crypto & fiat.

- Polymarket – Crypto-based platform; thousands of markets on politics, culture, global events.

- Interactive Brokers – ForecastTrader – Futures-style event contracts; politics, economics, climate.

- Ninja Traders (Tradovate partnership) – Event contracts on daily market prices & commodities.

- Railbird Exchange – New federally licensed market; expected 2026 launch.

- Manifold – Crypto-based, with “mana” and sweepcash options; pop culture & politics.

- PredictIt – Focused solely on political outcomes; operates under special CFTC no-action letter.

Locals Insider Disclaimer

Prediction markets operate under different regulations than traditional sportsbooks. Always check the legal status of each site in your state before signing up. Review each platform’s terms and conditions carefully, and understand the risks involved before using real money. In most US states, gambling and prediction markets are restricted to players aged 21 and older. Play responsibly and never risk more than you can afford to lose.

New Prediction Apps and Event Betting Sites 2026

A growing number of major U.S. sportsbooks, such as Fanduel and DraftKings, are moving beyond sports odds and into full prediction-market territory. What began as a niche crypto trend is now becoming a mainstream product category, with operators preparing to offer forecasts on politics, weather, economics, entertainment, and cultural events. The shift reflects both strong consumer demand and a belief among betting operators that they can outperform traditional prediction-market startups.

A fresh DraftKings Predictions app is live.

Fanatics Predicts

Fanatics CEO Michael Rubin confirmed the launch of Fanatics Predicts in 2026 supported by a new technology partnership with Crypto.com. He did not clarify whether Fanatics will operate a true contract-trading marketplace or focus on simple event odds. The new betteing product will launch across Fanatics’ 23 active states with expansion planned where regulation allows. Rubin said he believes sportsbook operators are better positioned to win this space.

DraftKings Predicts

DraftKings is preparing its own prediction feature, built on tech gained from its Railbird acquisition and collaboration with CME Group. A release window hasn’t been announced, but the company’s recent departure from the American Gaming Association suggests a strategic pivot toward event-contract products. DraftKings is expected to emphasize elections, macroeconomic numbers, and other high-volume public events. The product will likely debut inside the main DraftKings app.

FanDuel Event Markets

FanDuel is pursuing a similar track, also breaking from the AGA to move ahead with event-based markets. Early indications point to a tightly integrated product offering forecasts on weather, political outcomes, and government data releases. FanDuel faces pushback in states like Pennsylvania and Michigan but is expected to roll out where allowed. Its scale positions it to be one of the largest prediction-market players at launch.

PrizePicks Forecasts

PrizePicks entered the space fastest, forming a strategic partnership with Polymarket to bring event contracts onto its U.S. platform. The integration blends fantasy pick’em gameplay with real-world forecasting markets. The company is expected to focus on elections, entertainment events, and trending cultural questions. PrizePicks’ simplified interface may give it an edge among casual users.

Underdog Predictions

Underdog Fantasy quietly launched its first prediction-market tools in September via a partnership with Crypto.com. The initial rollout focused on sports-adjacent questions but will expand into broader public-event predictions. Underdog’s existing user base makes it well-positioned for adoption. Broader availability will depend on regulatory approval across key states.

TheScore Bet app may also launch its prediction odds app.

Are prediction markets considered gambling in the US?

This is the question regulators have been wrestling with for years. In practice, prediction markets don’t fall under the same category as sports betting apps like Bet365 or BetRivers, where you’re wagering against the house. Instead, they operate more like commodities exchanges, where users trade contracts based on real-world events.

Because of that, many platforms are overseen by the US Commodity Futures Trading Commission (CFTC) rather than state gambling boards. That distinction makes them legal in some states but not others, and it explains why certain apps—like Kalshi or Robinhood’s prediction hub—emphasize their compliance with federal oversight.

How do prediction markets actually work?

At their core, prediction markets run on simple yes-or-no contracts tied to a specific outcome: Will it rain in New York on Tuesday? Will the Fed raise rates in September?

Each contract is priced between $0 and $1, and the final value settles at $1 if the outcome happens, or $0 if it doesn’t. Traders make money by buying low and selling high before the event concludes, or by holding until the result is known.

This setup makes them feel more like stock market trades than traditional gambling slips, though the risk—and the adrenaline—can be just as high.

Which prediction market apps are legal to use right now?

Legality depends on the platform and the state you’re in. Kalshi, for instance, operates in 46 states but is blocked in Illinois, Nevada, New Jersey, and Ohio. Robinhood’s markets, built on Kalshi’s infrastructure, are accessible in nearly every state except Maryland.

Others, like Crypto.com’s Nadex-powered markets, have approval in all 50 states. Then there are gray-area platforms such as Polymarket, which was banned for a period before securing CFTC approval via a clearinghouse acquisition.

Always check the fine print—availability can shift quickly depending on regulatory updates.

Can you use crypto on prediction market platforms?

Some platforms lean heavily into cryptocurrency. Polymarket, for example, built its reputation around crypto-based contracts and now lists thousands of markets from politics to pop culture. Manifold also operates with its own currency system—users play with “mana” or a tokenized balance called “sweepcash” that can be exchanged for dollars.

On the other end of the spectrum, mainstream players like Robinhood and Kalshi deal exclusively in fiat currency, making them feel more familiar to users who already trade stocks or ETFs.

What’s the main risk of using prediction markets?

The volatility. Unlike betting on a fixed line at a sportsbook, prediction market prices shift constantly as news breaks and traders move in and out.

That means you can lock in a profit by selling early, but it also means values can collapse if sentiment swings the other way. A

dd in trading fees, potential state restrictions, and the occasional reliance on crypto rails, and the landscape can be confusing for newcomers.

The golden rule is the same as in investing or gambling: never put in more than you’re comfortable losing, and treat each contract as a speculative trade rather than a guaranteed outcome.

Do you have to pay taxes on prediction market winnings?

Yes. In the eyes of the IRS, profits from prediction markets are treated much like other investment or gambling earnings, depending on the platform.

If the site is CFTC-regulated—such as Kalshi or Robinhood’s prediction hub—your trades are considered capital gains, similar to buying and selling stocks.

That means you’ll owe short-term or long-term capital gains tax depending on how long you held the contract before selling.

On crypto-based platforms like Polymarket or Manifold, winnings may also trigger taxable events under crypto asset rules.

For example, if you invest $200 in contracts and cash out at $500, you’ve realized a $300 gain. That profit must be reported, and if it’s through crypto, you’ll also need to account for the coin’s value fluctuation between purchase and sale.

By contrast, if a platform is categorized closer to gambling under state law, your winnings may fall under gambling income.

In the U.S., gambling winnings of $600 or more can trigger a W-2G tax form.

For instance, if you made $2,000 in net winnings across prediction markets in 2026, you’d have to report that income and pay federal taxes on it (and possibly state taxes, depending on where you live).

More on taxes and gambling winnings here: www.irs.gov/taxtopics/tc419