Imagine a world where your most luxurious hotel stays don’t cost a dime. Where a simple credit card in your wallet is the key to complimentary upgrades, free nights, and exclusive experiences in some of the world’s most breathtaking destinations. This isn’t a fantasy—it’s the reality for millions of savvy travelers who have mastered the art of hotel rewards credit cards.

As we look to 2026, the landscape of travel rewards continues to evolve, with issuers constantly enhancing their offerings to win over your business.

This guide cuts through the confusion, offering a definitive breakdown of the best hotel rewards cards on the market.

We’ll compare the top contenders from the “big four” travel credit issuers — Chase, American Express, Citi, and Bank of America—and explain exactly why you need these hotel rewards cards, how to earn and redeem points, and how to turn your everyday spending into a life of elevated travel.

How We Define “Best” in the World of Hotel Cards

There is no single “best” card for everyone. The ideal hotel rewards credit card for you is a personal choice based on your spending habits, travel frequency, and loyalty to a specific hotel brand. When evaluating the best hotel cards, we focus on a few key factors that provide the most value:

- Annual Fee vs. Value: A high annual fee can be intimidating, but it’s often a gateway to an even higher return in free nights, statement credits, and elite status. The best cards are those that offer benefits that far outweigh the cost.

- Earning Potential: We look for cards that offer excellent point-earning rates on hotel stays, but also on everyday spending categories like dining, groceries, and travel.

- Free Night Certificates (FNCs): This is arguably the most valuable perk. Many cards offer an annual free night certificate that can be used at a wide range of properties, often saving you hundreds of dollars in cash.

- Elite Status: Complimentary elite status with a hotel program is a game-changer. It unlocks benefits like room upgrades, free breakfast, late checkout, and bonus points on every stay, making your travel more comfortable and luxurious.

- Point Redemption Value: Not all points are created equal. The “best” points are those that can be redeemed for high-value awards, often allowing you to get 2 or 3 cents in value for every point.

With these principles in mind, let’s explore the top five hotel rewards cards for 2026.

The Best Hotel Credit Cards for Free Nights, Status & Perks

1. The World of Hyatt Credit Card (Chase)

Chase and Hyatt have one of the most powerful partnerships in the rewards world. The World of Hyatt Credit Card is a favorite among savvy travelers for its simplicity and outsized redemption value.

Why It’s a Top Pick for 2025 and 2026: This is the best hotel card for maximizing redemption value. It’s a no-brainer for anyone who wants to use points for aspirational hotel stays. It’s also a perfect partner for a general travel card like the Chase Sapphire Reserve, as Ultimate Rewards points transfer to Hyatt at a 1:1 ratio.

Annual Fee: $95

Key Features: Earns 4x points on all Hyatt purchases and 2x on dining, flights, local transit, and gym memberships. You get one annual free night certificate valid at a category 1-4 Hyatt hotel. You also get Discoverist elite status, which offers late checkout and complimentary bottled water.

Credits & Freebies: Annual free night (up to category 4), additional free night when reaching $15k spend.

Status: Discoverist Status included (Lowest level). 5 qualifying nights per year, 2 nights per $5k spend. 30 nights needed to get to the next status level.

Pros: Hyatt points are incredibly valuable, often worth more than 2 cents each when redeemed for high-end stays. The annual free night certificate alone can easily justify the card’s annual fee, as it can be used at properties that would cost $200+ per night.

Cons: The earning rate outside of bonus categories is only 1x, which isn’t great for everyday spending. Hyatt’s footprint, while excellent for luxury properties, is smaller than Marriott’s or Hilton’s.

A Note on Chase and Experiences: You may have heard that Chase has added experiences to their card. This is true! Chase’s “Experiences” platform allows cardholders to redeem points for unique events like private dinners with celebrity chefs, exclusive concerts, and VIP access to sporting events. While not a traditional hotel redemption, this adds another layer of flexibility and high-value use for your valuable Chase Ultimate Rewards points.

Visit: creditcards.chase.com/travel-credit-cards/world-of-hyatt-credit-card

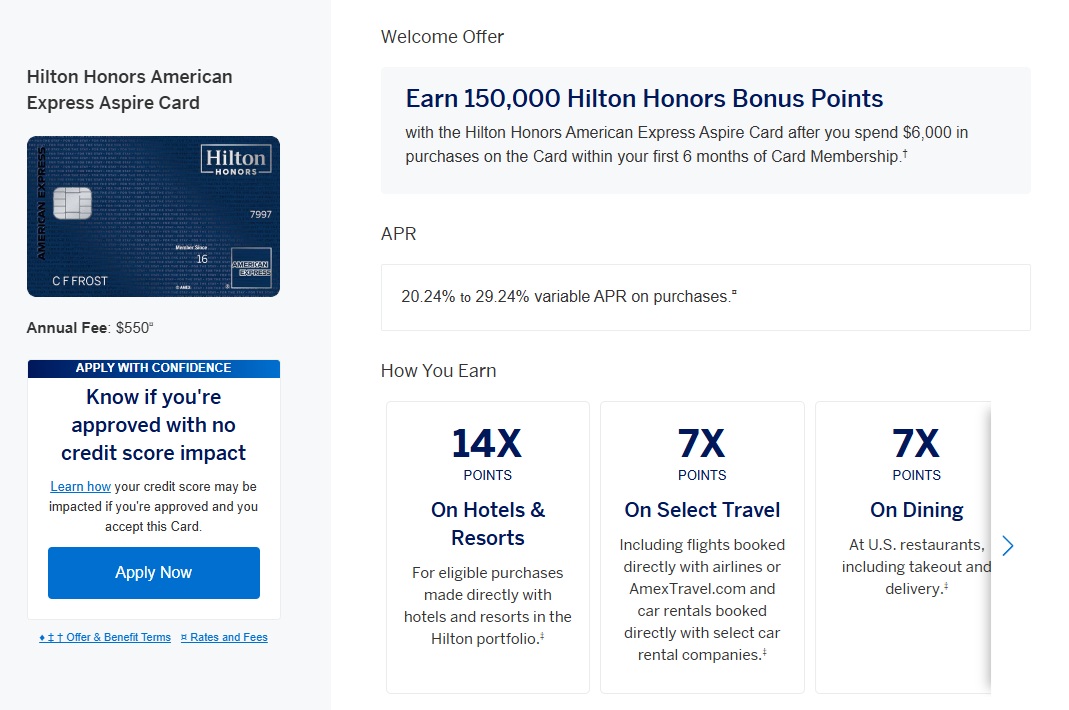

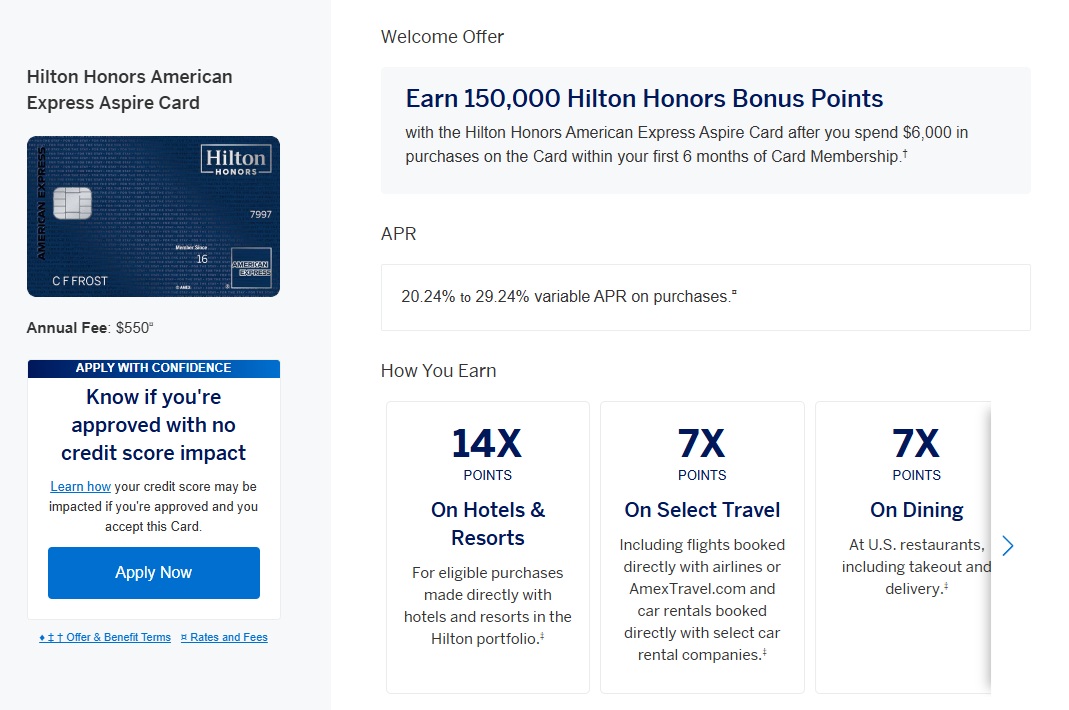

2. The Hilton Honors American Express Aspire Card (Amex)

For travelers who love luxury and want an abundance of perks from a single card, the Amex Hilton Honors Aspire card is unmatched.

Why It’s a Top Pick: This is the undisputed king of hotel credit card benefits. The value proposition is a home run for any traveler who prioritizes luxury and can take advantage of the numerous credits. Top tier status included means you don’t have to chase.

Annual Fee: $550

Key Features: Earns a massive 14x points on Hilton purchases. You get automatic Hilton Diamond status, which offers upgrades (when available), free breakfast at most properties, and a 100% point bonus on paid stays. It also includes one annual free night certificate valid at nearly any Hilton property, a $250 Hilton resort credit, and a $250 airline fee credit.

Credits & Freebies: Annual free night (any location), $400 annual Hilton resort credit ($200/half, resort properties only), $200 annual flight credit ($50/quarter), $209 annual Clear credit

Status: Includes Diamond status (Top Tier)

Pros: The sheer number of perks easily justifies the high annual fee. The Diamond status alone is worth hundreds in value, and the annual free night certificate can be used at ultra-luxurious properties like the Waldorf Astoria Maldives. The annual credits are also easy to use and offset a significant portion of the fee.

Cons: Hilton points are generally worth less than Hyatt or Marriott points. The high earning rate is necessary to get to a meaningful redemption. This card isn’t for those who don’t spend money on travel or who can’t use the credits.

Visit: americanexpress.com/us/credit-cards/card/hilton-honors-aspire

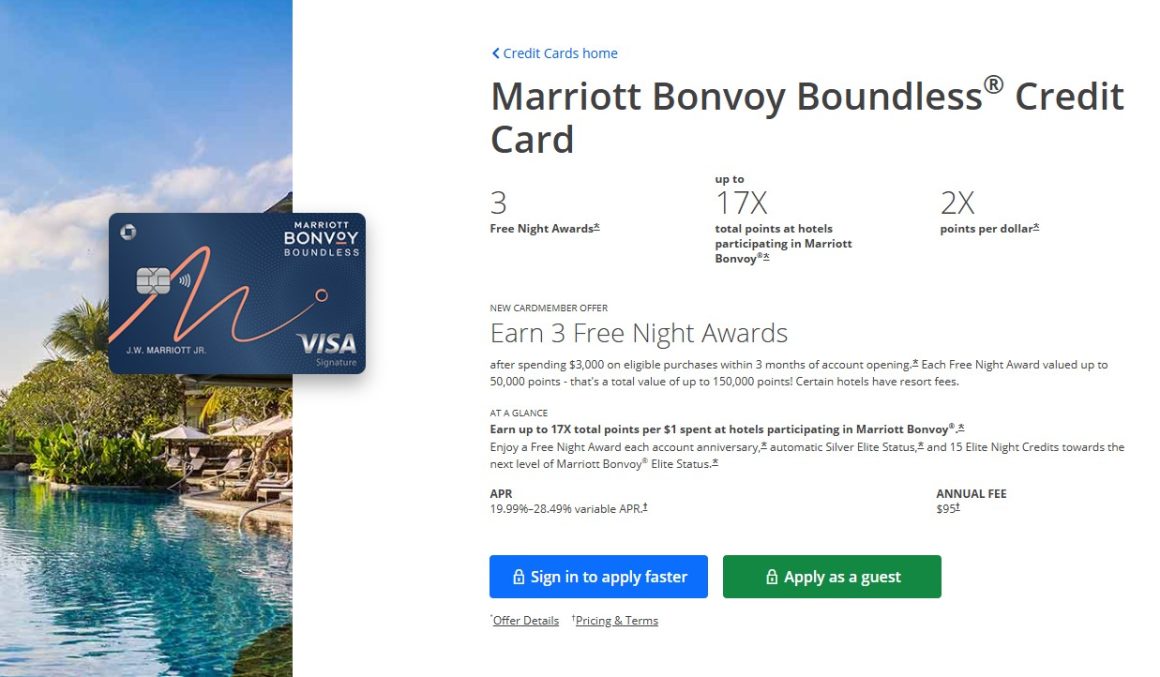

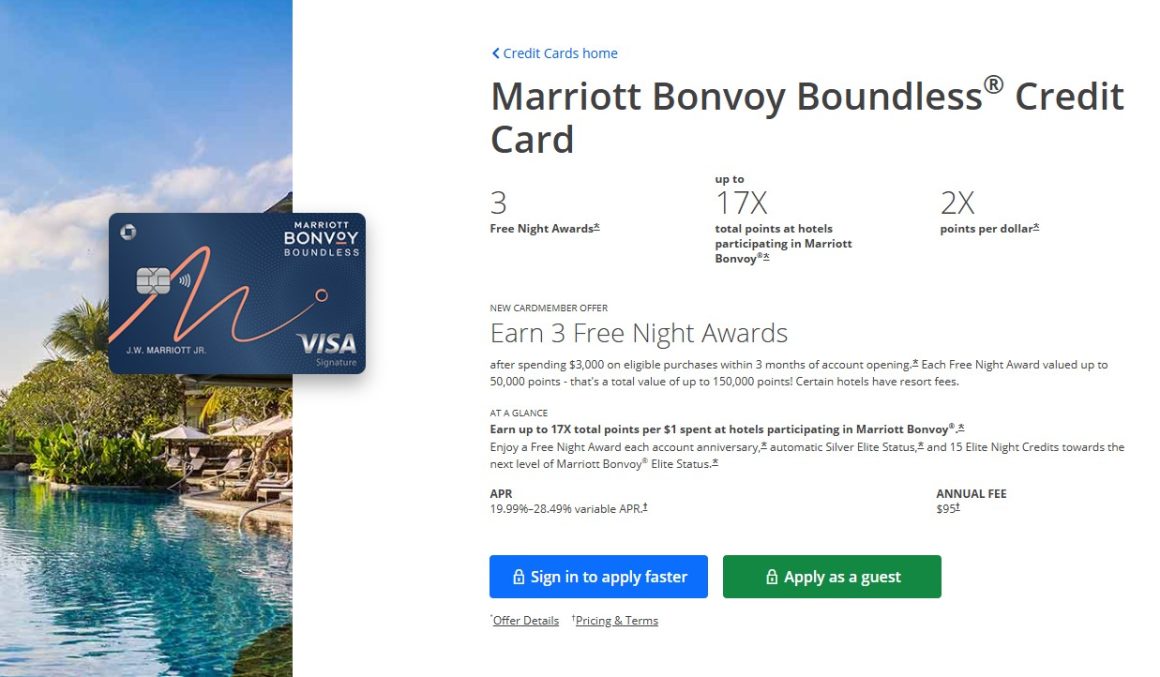

3. The Marriott Bonvoy Boundless Card (Chase)

The Marriott Bonvoy program is one of the largest in the world, with over 8,000 properties. The Bonvoy Boundless card is an excellent entry point into this massive network.

Why It’s a Top Pick: It offers incredible value for its low annual fee and is a great card for a traveler who wants to get into the Marriott ecosystem. The annual free night certificate alone is an excellent reason to hold this card.

Annual Fee: $95

Key Features: Earns 6x points on Marriott stays and 2x on everything else. You get one annual free night certificate valid at properties costing up to 35,000 points. The card also offers 15 elite night credits per year, putting you on the fast track to a higher status level.

Credits & Freebies: Annual free night (up to 35k points, can be topped off up to 50k)

Status: Silver status included (lowest tier), 15 qualifying nights annually, 50 qualifying nights needed to reach next level (gold). 1 qualifying night for every $5k spend.

Pros: This card’s primary strength is the sheer number of places you can redeem points. The 35,000-point free night certificate is a fantastic value, as it can be used for stays that cost well over $200. The 15 elite night credits make it much easier to achieve Silver or Gold status. Here is their free night deal.

Cons: The point value is not as high as with Hyatt. Some of the most aspirational Marriott properties require significantly more points, and the 35,000-point certificate has its limits.

Visit: creditcards.chase.com/travel-credit-cards/marriott-bonvoy/boundless

4. The Marriott Bonvoy Brilliant® American Express® Card (Amex)

For the dedicated Marriott loyalist who wants a fast track to premium perks, the Marriott Bonvoy Brilliant Card is the ultimate choice. It’s a top-tier card that provides an unparalleled suite of benefits.

Why It’s a Top Pick: This is the premier card for those who live and breathe Marriott travel. The combination of automatic elite status, a high-value free night award, and dining credits makes it a worthwhile investment for the luxury traveler.

Annual Fee: $650

Key Features: You get automatic Marriott Bonvoy Platinum Elite status, which offers room upgrades, late checkout, and free breakfast at many properties. You also receive an annual Free Night Award worth up to 85,000 points. The card provides up to $300 in statement credits per calendar year for dining purchases and a credit for Global Entry or TSA PreCheck.

Credits & Freebies: Annual free night (up to 85k, can be topped off up to 100k), $300 annual restaurant credit ($25/month), Priority Pass Select, Global Entry credit.

Status: Platinum status included (mid-tier), 25 annual Qualifying Nights,1 Qualifying night for each $5k spend. 75 Qualifying nights needed for next status tier (Titanium).

Pros: The Platinum Elite status is a game-changer, providing you with top-tier benefits from day one. The annual 85,000-point free night award is incredibly valuable and can be used at some of the most luxurious hotels in the Marriott portfolio, like the St. Regis or Ritz-Carlton. The dining credit helps offset a significant portion of the annual fee.

Cons: The annual fee is very high and requires you to be a frequent traveler who will use the perks to get a positive return. The earning rate on general purchases is low compared to other cards.

Visit: americanexpress.com/us/credit-cards/card/marriott-bonvoy-brilliant

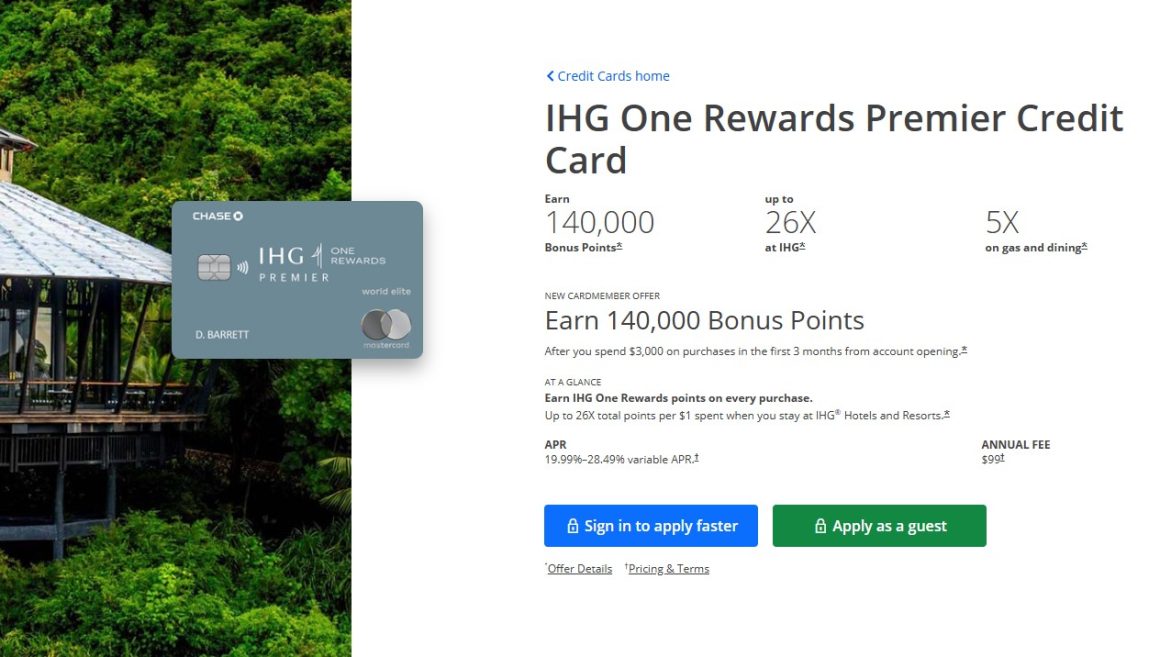

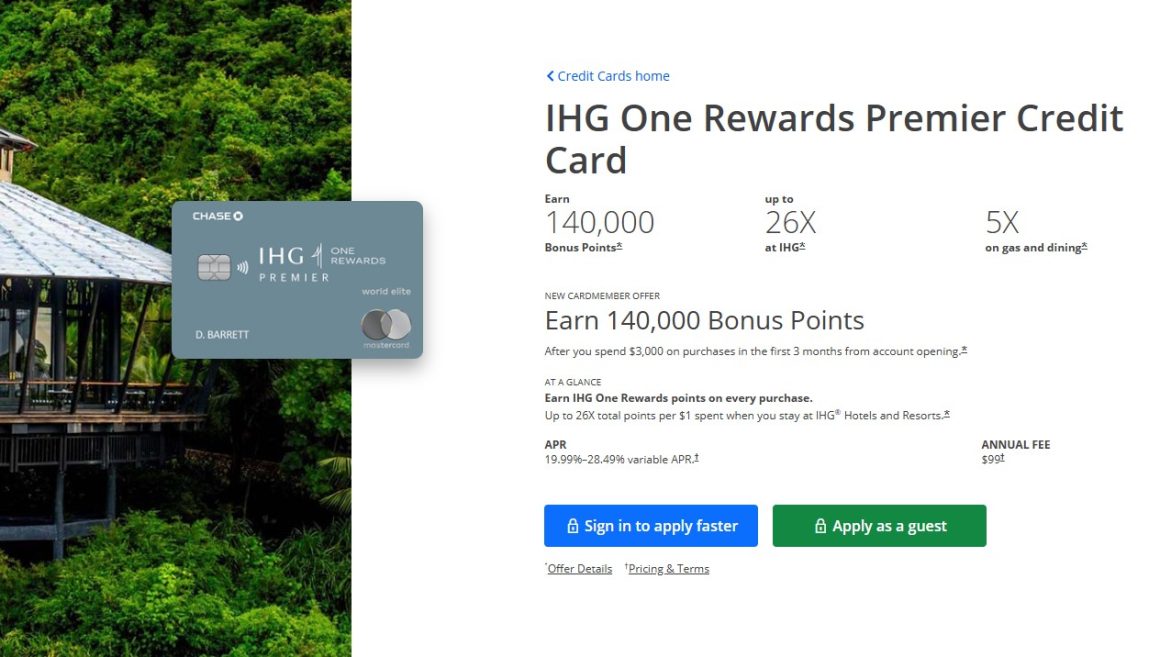

5. The IHG One Rewards Premier Credit Card (Chase)

For travelers who value reliable benefits and a large global footprint, the IHG One Rewards Premier Credit Card is an excellent choice. It’s a staple for earning points with brands like Holiday Inn, InterContinental, and Kimpton.

Why It’s a Top Pick: This card is a phenomenal choice for its long-term value. The combination of an annual free night, automatic elite status, and the fourth night free benefit makes it an incredibly strong card for anyone who stays at IHG properties even just a few times a year. It’s a low-cost way to get consistent value from your travel.

Annual Fee: $99

Key Features: You’ll earn 10x points on stays at IHG Hotels & Resorts and 5x on travel, gas, and dining. You also get an annual Free Night Award valid at properties costing up to 40,000 points. The card grants you Platinum Elite status as long as you are a cardholder, which includes perks like complimentary room upgrades and bonus points on stays. The fourth night is free when you redeem points for a stay of four or more nights.

Credits & Freebies: Annual free night award (up to 40k), 4th night free on redemptions, Global Entry/Precheck credit (every 4 years), $50 annual United travelbank credit, $100 and 10k point credit when spending $20k.

Status: Includes Silver status (lowest level), Spend $40k for Diamond status (top tier)

Pros: The annual Free Night Award alone can easily justify the card’s fee, especially when used at a high-value property. The included Platinum Elite status provides a great suite of benefits without having to meet stay requirements. The fourth night free on award stays is a fantastic perk that allows you to stretch your points even further.

Cons: IHG points are generally not as valuable as Hyatt points, often having a redemption value of less than 1 cent per point. The value of the free night certificate is capped, limiting its use at the most luxurious properties.

Visit: creditcards.chase.com/travel-credit-cards/ihg-rewards-club/premier

How to Earn and Redeem Points With These Hotel Rewards Cards

The true power of these cards lies in your strategy.

Earning Points & Referral Bonuses:

The single biggest way to earn points is through welcome bonuses. Many cards offer 50,000 or even 100,000 bonus points after a certain amount of spending, which can be enough for a week’s worth of free stays.

Use your hotel card for its bonus categories. For example, use your Hyatt card for all your dining and travel, while using your Capital One Venture X for everything else.

Many cards offer referral bonuses, where you can earn thousands of extra points for referring friends and family.

Redeeming Points & Cash:

The best value for your points almost always comes from redeeming them for premium hotel rooms. For example, a night at the Park Hyatt New York could cost upwards of $900, but it can be redeemed for just 30,000 Hyatt points. This provides a redemption value of 3 cents per point, which is far greater than the average 1 cent.

Your annual free night certificates are a goldmine. You can use a 35,000-point Marriott certificate for a stay at a resort like the Le Méridien Maldives Resort & Spa , which can cost over $500 per night.

Most programs offer the option to use a combination of cash and points for a stay. This is a great way to conserve your points for high-value redemptions or to stretch them when you are a few points short.

TOP Hotel Rewards Credit Cards – Compare Prices, Perks and Rewards!

World of Hyatt Credit Card

Welcome offer & APR

- Up to 60,000 Bonus Points: 30k after $3,000/3 mo; +30k via 2x on purchases that normally earn 1x (first 6 mo, up to $15k).

- APR: 19.99%–28.49% variable.

- Eligibility: No current card and no new‑cardmember bonus in the past 24 months.

Built‑in protections & extras

- No foreign transaction fees; tap‑to‑pay enabled.

- Trip cancellation/interruption (up to $5k per traveler, $10k per trip), baggage delay ($100/day up to 5 days), lost luggage (up to $3k/traveler), purchase protection (120 days, up to $500/item), rental car CDW (secondary in U.S.).

- Visa Signature Concierge; complimentary DashPass for 1 year + up to $10 off quarterly on eligible non‑restaurant DoorDash orders through Dec 31, 2027 (activation required).

Good to know

- 5 qualifying nights yearly; +2 nights per $5k spend.

- Pairs well with Chase Ultimate Rewards (1:1 to Hyatt).

Perks & credits

- Annual Category 1–4 free night.

- Extra free night after $15,000 in purchases.

Hilton Honors American Express Aspire

Welcome offer & APR

- 150,000 Hilton Honors points after $6,000 spend in first 6 months.

- APR: 20.24%–29.24% variable.

Earning structure

- 14x at Hilton hotels & resorts.

- 7x on select travel (flights direct/AmexTravel; car rentals with select companies).

- 7x at U.S. restaurants (including takeout/delivery).

- 3x on other eligible purchases.

Perks & credits

- $400 annual Hilton resort credit ($200 per half‑year; resort‑only).

- $200 annual airline fee credit ($50 per quarter).

- Up to ~$209 CLEAR® Plus credit per year.

- Annual free night certificate.

Earning tips

- Use Aspire for Hilton stays; use a strong non‑category card elsewhere.

- Stack with Hilton promos to accelerate point accrual.

Marriott Bonvoy Boundless®

Perks & credits

- Annual 35k Free Night Award (top off with up to 15k pts).

- 15 elite night credits yearly; +1 night per $5k spend.

Earning tips

- Use for Marriott stays; pair with a strong everyday earner for non‑bonus spend.

Marriott Bonvoy Brilliant®

Status track

- Includes 25 elite nights; 1 additional night per $5k spend.

- 75 nights required for Titanium.

Perks & credits

- $300 dining credit ($25 per month).

- Global Entry/TSA PreCheck credit; Priority Pass Select.

IHG One Rewards Premier

Welcome offer & APR

- 140,000 IHG points after $3,000 spend in first 3 months (often up to ~4 nights at many properties; varies).

- APR: 19.99%–28.49% variable.

Earning structure

- Up to 26x at IHG: 10x on the card + up to 10x as a member + up to 6x with included Platinum Elite.

- 5x on travel, dining, and gas; 3x other purchases.

Perks & credits

- Anniversary Free Night up to 40k; top off with your own points to book above the cap.

- Fourth Night Free on reward stays of 4+ nights.

- Global Entry/TSA PreCheck credit (every 4 years).

- $50 annual United TravelBank credit.

- $100 statement credit + 10k points after $20k calendar‑year spend.

- Diamond status after $40k annual spend (primary).

- Save 20% when purchasing IHG points; early access to Reward Night sales.

Earning tips

- Redeem in 4‑night blocks to maximize the Fourth Night Free benefit.

- Use Anniversary Night at high‑value 40k properties, topping off when needed.

Chase Ultimate Rewards® Experiences

Conclusion: Your Next Step to Free Hotel Stays

The world of hotel rewards can seem overwhelming, but with a solid strategy, you can turn your regular spending into free and luxurious travel. The best cards for you are the ones that fit your lifestyle and your travel goals.

Whether you choose to go all-in on the elite benefits of the Amex Hilton Aspire, the amazing redemption value of the Chase World of Hyatt, or the incredible value of the Amex Bonvoy Brilliant, the most important step is to choose a path and start earning. Analyze your spending, pick a card that aligns with your habits, and begin your journey to a world of free hotel stays.

Explore our map of the best flights or choose one of the best booking apps here.