The world of travel is ever-changing and so is the game of earning rewards. Forget scraping together a few thousand miles from a single flight. In 2026, the real jet-setters know that the most valuable asset in their wallet is a strategic travel credit card.

This isn’t just about paying for things; it’s about turning every dollar you spend—on groceries, gas, or that morning coffee—into a tangible ticket to your next adventure.

But with hundreds of cards on the market, each with its own dizzying array of points, perks, and fees, how do you find the one that’s right for you?

This guide cuts through the noise. I’m not just going to list cards; I’m going to show you how to think like a professional traveler.

We’ll define what “best” really means, break down the top contenders for 2026, and give you the actionable advice you need to turn your everyday spending into extraordinary experiences.

What Defines the “Best” Travel Credit Card?

Before we dive into the specific cards, let’s get one thing straight: there is no single “best” card for everyone. The perfect card for a family of four who takes one major vacation a year is completely different from the perfect card for a solo business traveler who is constantly on the road. The true definition of “best” depends on a delicate balance of four key factors.

First, the value of the annual fee

Many of the top-tier cards come with annual fees that can seem steep—often $400 or more. But here’s the secret: these fees are almost always offset by the value you get in return.

Think about it. If a card charges a $550 annual fee but gives you a $300 travel credit, lounge access that would cost you $200 a year, and travel insurance worth another $100, you’re already coming out ahead.

The “best” card is one where the benefits it provides far exceed its price tag.

Second, the earning rate on your specific spending habits

A card that offers 5x points on flights is useless if you rarely fly. Conversely, a card that gives you 3x points on dining and groceries is a gold mine if that’s where most of your budget goes.

The best card for you will have a generous points-earning structure that aligns with your lifestyle.

Third, the flexibility of the rewards

Not all points are created equal. Some cards offer a fixed value (e.g., 1 cent per point), which is simple but limits your potential.

The truly powerful cards are those that earn transferable points. These points can be moved to a variety of airline and hotel loyalty programs, often unlocking premium award redemptions—like a first-class seat to Europe that would cost tens of thousands of dollars if purchased with cash.

This flexibility is the key to aspirational travel.

Finally, the travel-related perks

This is the gravy on top. Perks like Priority Pass lounge access, Global Entry or TSA PreCheck credits, and comprehensive travel insurance (for lost baggage, trip delays, and cancellations) don’t just save you money—they make your travel experience more comfortable and stress-free.

Now that we know what to look for, let’s explore the cards that are leading the pack in 2026.

The Contenders Compared: The Best Travel Credit Cards for the US for 2026

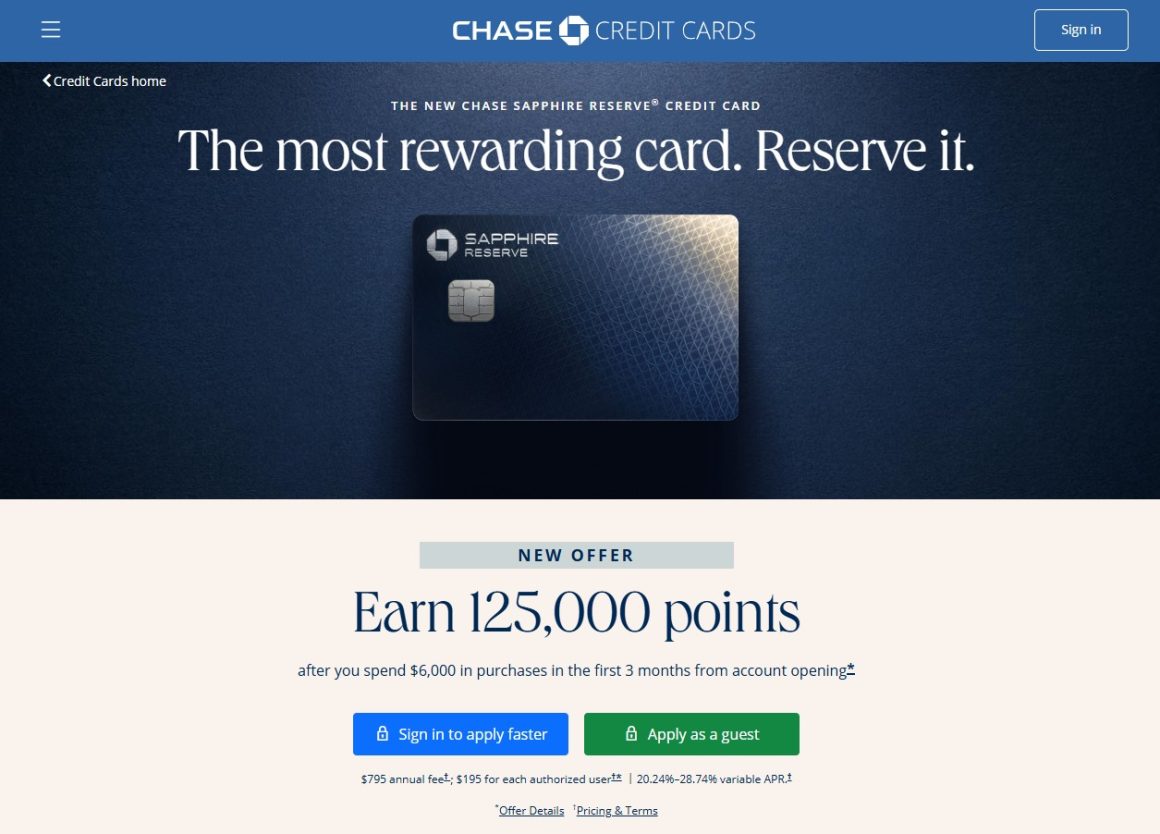

The Chase Sapphire Reserve

The Chase Sapphire Reserve has long been a favorite in the travel community, and for good reason. It’s a workhorse of a card that offers simplicity, flexibility, and tangible value.

The Chase Sapphire Reserve is the best all-around travel card for a reason. It’s perfect for people who want to earn points on everyday spending, but don’t want to get bogged down with a complex points strategy. It’s simple, powerful, and a great entry point into premium travel cards. The annual credits easily make up for the beefy annual fee.

Who It’s For: The discerning traveler who values simplicity, has high travel and dining spending, and wants a card that offers solid value without a lot of hassle.

Pros: The $300 annual travel credit is incredibly easy to use and effectively lowers the annual fee to just $495. The 1.5 cent redemption rate is a fantastic baseline value, and the transferable points open up a world of high-value redemptions. Strong lounge access, especially if you visit Chase lounges and lots of great credits and perks.

Cons: The earning rate on non-category spending is a lackluster 1x. The card doesn’t offer as many luxury perks as some of its competitors. Lots of credit management needed.

Annual Fee: $795

Points & Earning: Earn 4x points on travel (double if booked through Chase), 3x points on dining worldwide Earn 1x on everything else. Points are worth up to 1.5 cents each when redeemed for travel through the Chase Ultimate Rewards portal, or can be transferred to a wide range of partners like United, Hyatt, and Southwest.

Chase Sapphire Reserve Credits & Freebies:

- $300 annual travel credit,

- $500 annual hotel credit (1 biannual $250 credits) via Chase’s The Edit portfolio

- $300 annual Stubhub credit (1 biannual $150 credits)

- $300 annual dining credit via Opentable (1 biannual $150 credits)

- $300 annual Doordash credits (in monthly increments)

- Free Apple TV and Apple Music subscriptions

- $120 annual Lyft credits ($10 per month)

- $120 Global Entry/TSA Precheck/Nexus credit (once every 4 years)

- $120 Peloton credit ($10 monthly)

Lounge Access: Priority Pass membership with 2 free guests, Chase Sapphire Lounge access with 2 free guests, Air Canada Maple Leaf Lounge access when flying on a Star Alliance airline.

Airline/Hotel Status: IHG Platinum Elite status. Can unlock Southwest A-list status with $75k spend.

Chase Sapphire Reserve Sign Up Bonus

125,000 points after spending $6000 in the first 3 months (as of August 2025). This bonus alone is valued at $2000

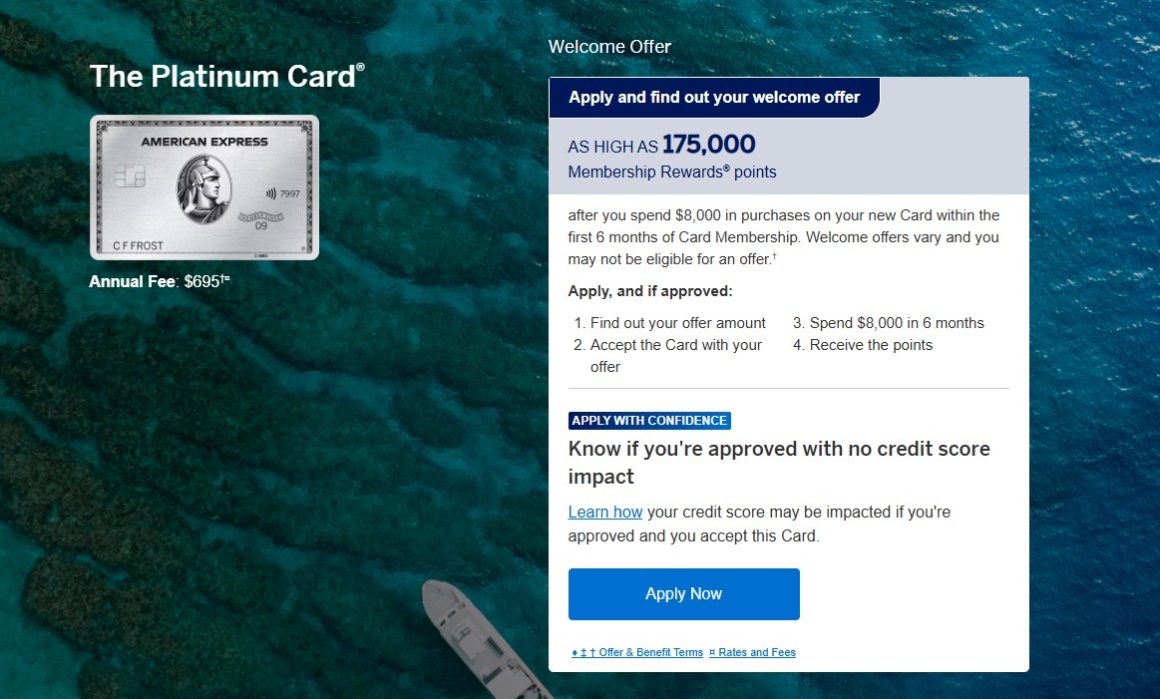

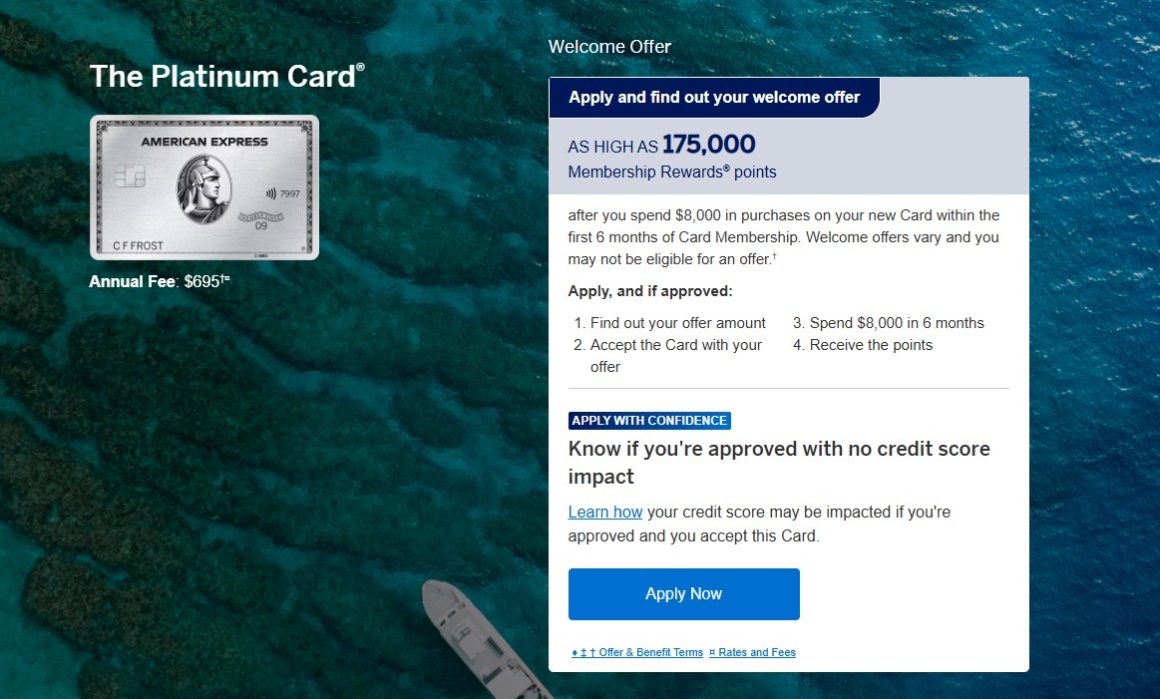

The Amex Platinum Card

The Amex Platinum Card is less of a credit card and more of a key to a luxury lifestyle. It’s all about the perks and benefits that elevate your entire travel experience.

This card isn’t for everyone. It’s for the person who travels frequently and can take full advantage of the immense perks. In the right hands, it’s an absolute powerhouse that offers unrivaled luxury. It’s the card you carry for the experience, not just for the points. It is by far the best overall card for lounge access.

Who It’s For: The frequent traveler who values luxury, is willing to put in the effort to use all the benefits and wants a premium travel experience.

Pros: This card’s biggest selling point is its incredible suite of benefits. It offers the best lounge access in the industry, including Centurion Lounges, Delta Sky Clubs (when flying Delta), and Priority Pass.

It also comes with a host of credits, including an airline fee credit, Uber credits, hotel credits, and Saks Fifth Avenue credits, which can easily exceed the annual fee.

The customer service is also top-notch, as is the suite of insurance and protection when traveling. Earning 5x points on airline purchases is also the best out there.

Cons: The annual fee is intimidatingly high. The earning rate outside of flights is very poor, making it a bad choice for everyday spending. The credits require active use to be worthwhile and can feel like a chore.

Annual Fee: $695

Points & Earning: Earn 5x points on flights booked directly with airlines or through Amex Travel. Earn 5x points on prepaid hotels booked with Amex Travel. Earn 1x on everything else. Amex Membership Rewards points can be transferred to a wide variety of airline and hotel partners.

The Amex Platinum Card Credits & Freebies:

- $200 annual airline credit (for incidentals on a select US airline

- $200 annual hotel credit (Fine Hotel and Resorts properties)

- $240 annual Entertaiment credit ($20 monthly for various streaming services)

- $200 Uber credit (divided monthly)

- $100 annual Saks Fifth Avenue credit ($50 biannually)

- $209 Clear membership, Free Walmart+ membership

- $120 Global Entry/TSA Precheck/Nexus credit (once every 4 years)

Lounge Access: Priority Pass membership with 2 free guests, Amex Centurion Lounge access (fee for guests), Delta Skyclub access when flying Delta (extra fee for guests), Escape lounge access, Plaza Premium lounge access.

Airline/Hotel Status: Marriott Gold status, Hilton Gold status.

The Capital One Venture X Card

The Capital One Venture X burst onto the scene and immediately became a serious competitor. It offers a premium feel at a much more approachable price point.

The Venture X is the best premium travel card for the everyday person. It’s the perfect balance of simplicity, value, and premium benefits. The 2x on everything makes it a fantastic catch-all card for all of your purchases.

Who It’s For: The traveler who wants a simple, high-value card for all of their spending without paying a top-tier annual fee.

Pros: The combination of a lower annual fee, a simple 2x earning rate on all spending, and a $300 annual travel credit makes this card a winner. The travel credit effectively lowers the annual fee to just $95.

It also includes Priority Pass and Capital One lounge access, as well as a Global Entry or TSA PreCheck credit. The simple earning structure is a huge plus for people who don’t want to manage multiple cards. The card also comes with a strong travel insurance product.

Cons: While the travel portal is easy to use, you have to book through it to get the elevated points-earning rates and to use the travel credit. This can sometimes be less flexible than booking directly with a travel provider.

Annual Fee: $395

Points & Earning: Earn 2x points on every single purchase, everywhere, with no limits. Earn 10x on hotels and rental cars booked through the Capital One Travel portal, and 5x on flights booked through the portal. Points can be transferred to an extensive list of airline and hotel partners.

The Capital One Venture X Card Credits & Freebies:

- $300 annual travel credit,

- 10k points every anniversary,

- $120 Global Entry/TSA Precheck/Nexus credit (once every 4 years).

Lounge Access: Priority Pass membership (extra charge for guests), Capital One lounge access (extra charge for guests).

Airline/Hotel Status: Hertz Presidents Circle

Why You Need These Travel Cards

| Card | Annual Fee | Points & Earning | Key Perks & Credits |

|---|---|---|---|

| Chase Sapphire Reserve | $795 (≈$495 w/ credits) | 4x travel, 3x dining, 1x other | $300 travel credit, $500 hotel credit, dining & entertainment credits, Priority Pass + Chase Lounges |

| Amex Platinum | $695 | 5x flights/hotels (Amex Travel), 1x other | Centurion + Delta Sky Clubs, $200 airline + $200 hotel credits, Uber & Saks credits, Marriott & Hilton Gold |

| Capital One Venture X | $395 (≈$95 w/ credits) | 2x all, 5x flights (portal), 10x hotels/cars (portal) | $300 travel credit, 10k anniversary miles, Priority Pass + Capital One Lounges, Hertz Presidents Circle |

Beyond the points and credits, these cards fundamentally change the way you travel. They are not just payment tools; they are travel companions that provide:

Luxury for Free

These cards are your ticket to business-class flights and exclusive resort stays. The points you earn on daily purchases can be redeemed for experiences that would be out of reach if you had to pay cash. This is the essence of “travel hacking”—using your everyday spending to access luxury you could never afford otherwise.

Peace of Mind

The travel protections included with these cards are invaluable. Trip delay insurance covers food and lodging if your flight is delayed for a certain period. Trip cancellation and interruption insurance can save you thousands if an emergency forces you to cancel. And rental car insurance means you can decline the expensive coverage at the rental counter.

A Smoother Journey

Imagine skipping the chaos of a crowded airport terminal and heading straight to a comfortable lounge with complimentary food and drinks. That’s a standard perk with these cards. The lounges provide a serene oasis before your flight, making the travel experience itself enjoyable.

Strategic Spending: Where to Use Your Cards

To truly maximize your points, you need a strategy. The “best” card is often not one card, but a combination of two or three. Here’s how to think about it:

The Travel & Dining Card

Use a card like the Chase Sapphire Reserve or Amex Platinum for flights, hotels, and all restaurant bills. These are your heavy-hitters for the highest-value earning categories.

The “Everywhere Else” Card

This is where the Capital One Venture X shines. Use it for all of your spending that doesn’t fall into a bonus category—groceries, utilities, and general retail. Its 2x earning rate is far superior to the 1x you’d get on most other premium cards.

Redemption is Key

Once you have a stash of points, you need to know how to use them. The power of transferable points lies in their flexibility. For example, you can transfer your Chase points to Hyatt for a valuable hotel stay or to United for a flight to a dream destination. Always compare redemption values before you book.

Ultimately, your points strategy should be a reflection of your travel goals. Do you want to take one big luxury trip per year, or many small trips? Your choice of cards and how you use them will determine your success.

Conclusion: Your Next Step

In 2026, the best travel credit card is the one that aligns with your life, not the one with the highest number in a headline. The Chase Sapphire Reserve, Amex Platinum, and Capital One Venture X represent the top of the market, each offering a unique path to incredible travel.

The most important step you can take is to analyze your own spending and travel habits. Once you know where your money goes, you can choose a card—or a combination of cards—that will turn every purchase into a step toward your next great adventure. The world is waiting. The time to start earning is now.

Locals Insider Disclaimer: The travel cards selected and suggested by Gabe Douek, seasoned traveler, travel adviser and owner of Vantage Point Travel.

List of the TOP Popular U.S. Travel Credit Cards

- World of Hyatt (Chase) — Free night award + strong hotel value.

- Chase Sapphire Reserve — Flexible points with strong travel credits.

- Chase Sapphire Preferred — Low fee, great starter travel card.

- Amex Platinum — Best for luxury perks and lounge access.

- Amex Gold — Excellent for dining and grocery rewards.

- Amex Green — Good entry-level travel perks at low fee.

- Capital One Venture X — Simple 2x on everything with lounge perks.

- Capital One Venture Rewards — Easy flat-rate miles, no fuss.

- Capital One VentureOne — No annual fee travel card option.

- Citi Premier — Strong airline and hotel transfer partners.

- Citi AAdvantage Platinum Select — Best for American Airlines travelers.

- Citi AAdvantage Executive — Admirals Club lounge access included.

- United Explorer Card — United flyers get free bags + boarding.

- United Quest Card — Extra miles and annual United credits.

- United Club Infinite — Includes United Club membership.

- Delta SkyMiles Gold Amex — Affordable card with free checked bag.

- Delta SkyMiles Platinum Amex — Companion certificate each year.

- Delta SkyMiles Reserve Amex — Sky Club + MQM boosts for status.

- Southwest Rapid Rewards Plus — Earn points toward Companion Pass.

- Southwest Rapid Rewards Priority — $75 annual travel credit.

- JetBlue Plus Card — Free checked bag + TrueBlue perks.

- JetBlue Business Card — Good for frequent JetBlue flyers.

- Alaska Airlines Visa Signature — Famous Companion Fare benefit.

- Alaska Airlines Visa Business — Companion Fare plus business perks.

- Hilton Honors Surpass (Amex) — Lounge passes + strong Hilton earnings.

- Hilton Honors Aspire (Amex) — Automatic Diamond status.

- Marriott Bonvoy Boundless (Chase) — Free night certificate each year.

- Marriott Bonvoy Brilliant (Amex) — Lounge access + Platinum status.

- IHG Rewards Premier (Chase) — 4th night free on redemptions.