Travel may be smoother to book than ever—but once you’re on the move, reality can get messy. Flights are delayed or canceled, luggage goes missing, and an unexpected medical bill abroad can wreck even the best-planned budget.

In 2024, U.S. travelers spent an estimated $5.6 billion on travel insurance, covering nearly 87 million people across 55 million plans—a massive increase compared with pre-pandemic levels. The surge reflects how risk-aware travelers have become, with protection now seen as a must-have rather than an optional add-on.

At the same time, flight disruption claims have grown into a multibillion-dollar industry. The global market for flight delay and cancellation compensation was worth around $11 billion in 2023 and is forecast to nearly double to $26 billion by 2031.

And with roughly seven in ten Americans experiencing a major disruption—whether a delay, cancellation, or lost bag—in the past year alone, the demand for services that recover compensation is only accelerating.

Here are the best services for insurance coverage and flight compensation in 2026 – designed to keep your journey protected, even when the unexpected happens.

VisitorsCoverage

VisitorsCoverage has become a global go-to, serving 1 million+ travelers across 197 countries. It offers almost every type of coverage: international medical insurance, trip cancellation, Schengen visa insurance, cruise policies, and “Cancel for Any Reason” add-ons. Buying takes under 5 minutes online, and policies are issued instantly.

A two-week comprehensive plan for a mid-30s traveler might cost around $80–$100, while older travelers pay more depending on coverage limits. They work with well-known underwriters such as IMG, Lloyd’s, and Nationwide, giving users a wide range of price points and benefits. Customers especially appreciate the comparison tool, which lets you line up multiple policies side by side before purchasing.

Strengths: Wide global coverage, 24/7 claims assistance, and options for pre-existing condition coverage.

Weaknesses: The cheaper “limited” plans cover little more than basics, so it pays to read the fine print.

EKTA

EKTA is a European provider known less for flashy branding and more for fast claims turnaround. Policies cover medical emergencies, lost luggage, and trip interruptions, but the standout is how quickly people actually get reimbursed. Some reviewers reported being refunded within a week, compared to the industry norm of several months.

A week of coverage within Europe costs around €30–40, making it affordable for short trips. Their 24/7 multilingual support is consistently praised — especially useful when you’re stranded and need to speak to a real person.

Best for: Travelers who want no-nonsense coverage and quick payouts, even if the range of plan options is slimmer than bigger brokers.

Insubuy

U.S.-based Insubuy has been around since 2000 and is particularly strong for visitors to America, students, and immigrants. It offers an extensive lineup: Travel LX, SE, Lite, Safe Travels, and Voyager plans, all covering different levels of trip cancellation, interruption, medical evacuation, baggage loss, and COVID-19.

For example, Travel LX can reimburse up to $1,000,000 for evacuation and repatriation, and includes telemedicine. A typical one-week plan for a U.S. resident costs between $50 and $120 depending on age and add-ons. Students on visas can buy semester-long policies that cover medical emergencies and repatriation — essential for meeting university requirements.

Strengths: Licensed U.S. agents available by phone or chat, detailed side-by-side comparisons, and long experience in immigrant/student insurance.

Weaknesses: Premiums rise steeply for seniors, and like most brokers, claims are routed through underwriters, not Insubuy itself.

AirHelp

AirHelp is one of the most recognized names in passenger rights. If your flight in or out of Europe is delayed, cancelled, or overbooked, AirHelp helps you claim under EU Regulation 261/2004. You can get up to €600 per passenger, depending on the route and delay length.

The system is simple: enter your flight number, and AirHelp calculates eligibility. If they win your case, they take a cut (usually 25–35%). If they don’t, you pay nothing. For example, a New York–London passenger received €400 after a four-hour delay — something they never would have pursued alone.

Strengths: Global recognition, smooth app interface, strong success record in Europe.

Weaknesses: Fees are higher than some competitors, and coverage outside EU law is patchier.

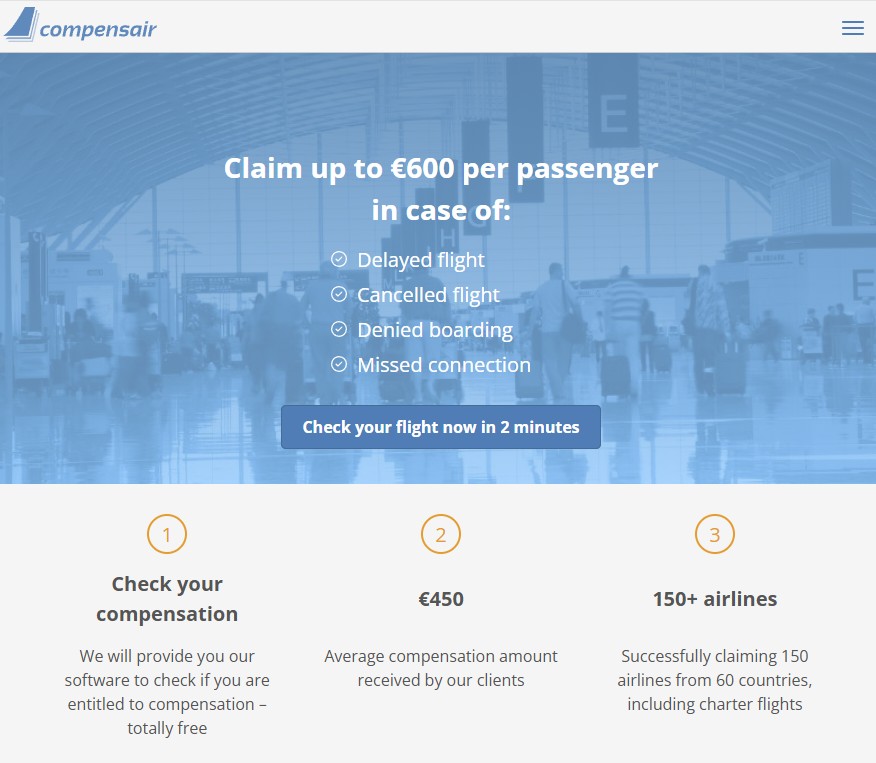

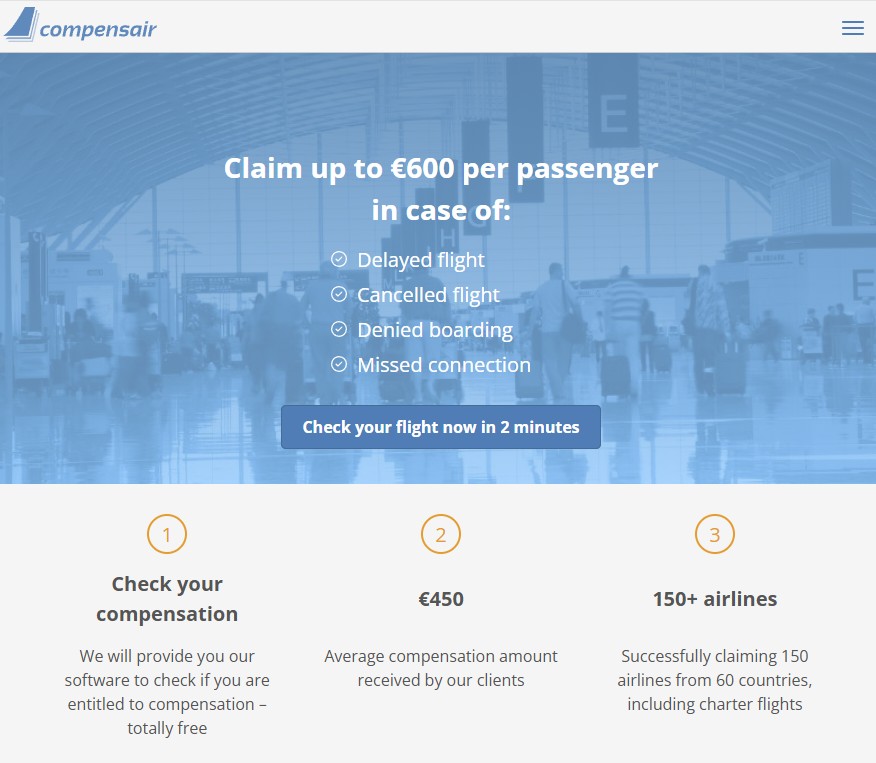

Compensair

Compensair works in a similar space to AirHelp but casts a wider net: it has processed claims across 150 airlines in 60 countries, including charter operators. The average payout is around €450 per passenger, with maximums up to €600 depending on distance.

How it works:

- Submit your flight details — eligibility check takes about 2 minutes.

- If your case qualifies, Compensair handles negotiations and, if needed, legal proceedings.

- You get paid, usually by bank transfer, once the airline complies.

Reviews (average 4.7/5) highlight fast service and unexpected wins, even for flights disrupted years ago. One passenger was reimbursed for a 5-hour Swiss Air delay from four years back. Eligible cases include delays over 3 hours, cancellations, denied boarding, and missed connections under one booking.

Strengths: Strong legal support, works with older cases, average payouts above €400.

Weaknesses: Like AirHelp, you must be flying routes covered by EU261, so U.S. domestic-only flights aren’t eligible.

VisitorsCoverage

Strengths

- Global footprint (197 countries).

- Comparison tool across underwriters.

- Options for pre-existing condition coverage.

Weaknesses

- Budget plans offer minimal coverage—check details carefully.

EKTA

Strengths

- Rapid reimbursements (days, not months).

- Affordable for short trips in Europe.

- Strong multilingual assistance.

Weaknesses

- Limited variety of plan options vs. larger brokers.

Insubuy

Strengths

- Trusted broker with 20+ years’ experience.

- Detailed plan comparisons and telemedicine add-ons.

- Licensed agents available by phone/chat.

Weaknesses

- Premiums rise sharply for seniors.

- Claims routed via underwriters, not Insubuy directly.

AirHelp

Strengths

- Recognized brand with slick app.

- High EU claim success rates.

- No cost if claim fails.

Weaknesses

- Fees higher than some competitors.

- Limited effectiveness outside EU law.

Compensair

Strengths

- Broad airline and country coverage.

- Strong reviews (4.7/5 avg).

- Can process cases years after disruption.

Weaknesses

- Restricted to routes under EU regulations.

More Travel Insurance & Compensation Services for U.S. Travelers for 2026

Here are additional options worth knowing if you’re based in the U.S. or travel internationally often:

- Berkshire Hathaway Travel Protection – Quick payouts with niche plans for cruises and adventure trips.

- Allianz Global Assistance – Flexible single-trip and annual policies, strong emergency coverage.

- Travel Guard (AIG) – Reliable choice if you need pre-existing condition waivers.

- World Nomads – Covers 200+ adventure activities like scuba or snowboarding.

- Seven Corners – Good for topping up credit card coverage; includes “Interruption for Any Reason.”

- Chubb / AXA / Travel Insured International – Luxury coverage, affordable group plans, even pet add-ons.

- FAA / DOT Refund Rules – U.S. law guarantees automatic refunds for cancellations or major delays if you don’t accept rebooking.

- AirAdvisor – Helps U.S. passengers claim up to $650 for delays or cancellations.

- Refund.me – Handles claims with 250+ airlines in 110 countries, success-based fee.

In short:

Need help with a flight delay or cancellation? Use Compensair for the best results, and bookmark AirHelp as a solid alternative.

Insure your trip with VisitorsCoverage or EKTA—both offer reliable protection, but EKTA takes the lead for speed.

Explore these apps and websites for finding affordable flights or use our flight deals.